Pets bring so much joy and companionship to our lives. We want to do our best to keep them happy and healthy, just like any other member of our family. Vet bills can get costly over the lifetime of a pet, especially if there is an accident or illness. Pet insurance can help to mitigate vet costs. There are many types of pet insurances available. Remember these key points when making a comparison of pet insurance companies.

1) Proven Reliability

When making a comparison of pet insurance, make sure to note how reliable each brand of insurance is. A well-established brand has a few things going for it. First, it is less likely for their premiums to change. They have experience in the industry and know how to set their prices accordingly. Second, a well-established brand can be counted on to stay in business for the lifetime of your pet. You don’t want to have to shop for pet insurance every few years.

2) Reimbursement

It is important to consider how each brand makes their reimbursements when making a comparison of pet insurance. With most pet insurance companies, you pay the vet and then submit a claim to the insurance company. The insurance company will then reimburse you the amount based on your plan. The time it takes for insurance companies to reimburse, you can vary greatly.

Some vet bills can be quite expensive, and the time between paying the vet and being reimbursed needs to be short, so you do not incur interest charges on your credit card or out of pocket for any length of time. Most pet insurance companies reimburse through direct deposit to speed up the process. There are a few insurance companies that pay the vet directly, which might be a better option for you, depending on your financial situation. Keep this in mind when looking at a comparison of pet insurance.

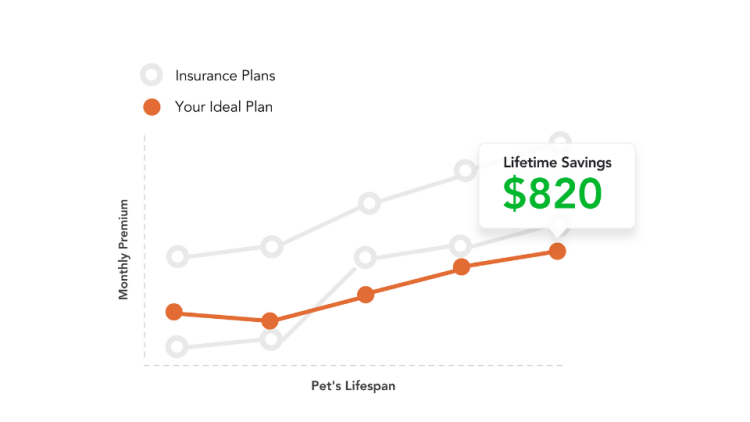

3) Cost Over the Lifespan of Your Pet

As pets age, pet insurance premiums increase. Make sure to take into account the cost over the entire lifetime of your pet when making a comparison of pet insurance. Some companies may seem like a better deal for a young pet, but the premiums increase dramatically later in your pet’s life.

Sticking with the same insurance company for the lifetime of your pet is also important because most policies do not include pre-existing illnesses. Using a service like Pawlicy’s Lifetime Value Score makes a comparison of pet insurance over the pet’s lifetime much less complicated.

Whichever pet insurance policy you choose, make sure it is the best for you and the health of your pet. Nobody wants to be stuck in a situation where their pet is suffering, and the vet bills are too expensive. When making a comparison of pet insurance, keep in mind the reliability of the insurance company, how the vet bills are paid, and the total cost over your pet’s lifetime. Choosing the right pet insurance company when your pet is young will pay off in the long-term.