Does Pet Insurance with No Deductible Exist?

Licensed Insurance Producer - Pawlicy Advisor

Does Pet Insurance with No Deductible Exist?

Most people who have owned a dog, cat, or even a parakeet understand the immense happiness and connection of having a pet. While the benefits of pet ownership are endless, the associated costs can also seem never-ending.

These costs can increase rapidly, particularly if you pay out of pocket. Pet insurance is popular among pet owners to help cover these unforeseen expenses. While policies vary by provider, they all include a deductible you must meet before the policy becomes effective.

We're often asked whether pet insurance offers a $0 deductible option. So, does pet insurance with no deductible exist? Here is everything you should know.

Some people can predict the future.For everyone else, there's pet insurance.

Understanding Pet Insurance Deductibles

Similar to human health insurance, a pet insurance deductible is the sum you must pay upfront before coverage goes into effect.

Once you've spent the required amount on your pet's vet bills, your insurance policy will kick in and begin helping to cover eligible costs, minus your co-insurance share. A lower deductible means you're able to get reimbursed for claims while paying less out-of-pocket, while a higher deductible means you'll need to cover more costs before you can lean on your insurance policy.

The deductible amount can vary significantly, ranging anywhere from a couple hundred to a couple thousand dollars. Many providers also allow you to customize your pet insurance deductible — so, is $0 an option?

Is there pet insurance with no deductible?

Yes, some companies offer pet insurance with a $0 deductible. These examples include:

- MetLife Pet Insurance: Deductible options range from $0 to $750 (in $50 increments), $1,000, $1,250, $2,000 and $2,500.

- Trupanion Pet Insurance: Deductible options range from $0 to $1,000 in $5 increments.

- Trusted Pals Pet Insurance: Deductible options include $0, $100, $250, $500, or $750.

While it's possible to find pet insurance with no deductible, it's very uncommon. Most carriers require some cost-sharing from pet owners to keep premiums affordable and avoid exploitation of the insurance system.

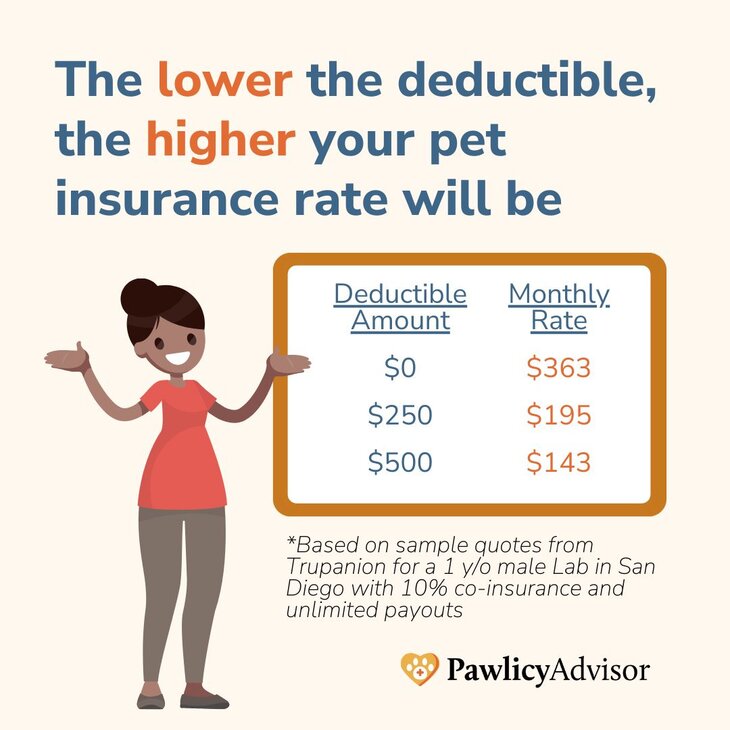

The premium rate on pet insurance plans with $0 deductible are typically much more expensive than those with higher deductible amounts, which can significantly increase the overall cost of the policy.

Carefully consider if such a plan is financially feasible for you and your pet.

Factors to consider when selecting a pet insurance deductible

When selecting a pet insurance deductible, you should take the following factors into consideration:

Annual vs. per-incident deductible

There are different types of pet insurance deductibles depending on the company’s policy: annual and per-incident (also known as "per-condition").

- Annual deductibles: You pay the deductible once per year. After meeting it, additional claims are covered without another deductible that year. When the policy renews, the deductible resets. This setup is cost-effective for multiple claims in a year and makes your out-of-pocket cost more predictable.

- Per-incident deductibles: This deductible applies each time you file an insurance claim for a specific incident or condition.

Co-insurance

Your initial out-of-pocket costs will be the entire veterinary bill until your annual or per-incident deductible is met. After your deductible is paid, out-of-pocket costs will include the policy’s co-insurance (typically 10%, 20%, or 30% of eligible expenses) plus the full cost of any expense not covered by the policy, such as a pre-existing condition.

Impact on your monthly budget

Based on your budget, consider how much you can afford to spend on pet insurance each month. Lower deductibles save money on initial upfront costs, but they frequently lead to higher monthly premiums. Conversely, high deductibles require you to pay more upfront costs but offer lower monthly premiums.

Your risk tolerance

Determine how much financial risk you can tolerate. A lower deductible provides financial relief faster in an emergency but comes at a higher monthly price. Even if you can pay for it, you should confirm that the advantages of coverage with a low deductible exceed the disadvantages.

To evaluate if the additional expenses are justified, carefully review the coverage, exclusions, and terms to see if a $0 or low deductible pet insurance policy is right for you. You might benefit from having a higher deductible in certain situations.

Pet age and health risks

Assess your pet's general health and any medical requirements. If your dog or cat is young and healthy, you might select a plan with a higher deductible, anticipating fewer medical problems.

However, older pets or breeds predisposed to particular health issues may benefit more from a lower deductible.

Your preferred coverage

Ensure that you understand what your policy covers. The exclusions or limitations of some policies may impact the cost-effectiveness of various deductible alternatives.

For example, you may find a pet insurance plan with no deductible, but if the policy excludes coverage for a service important to you — such as diagnostic tests — not, it might be worth paying a higher deductible to have a policy that covers the services you care about.

Choosing the best pet insurance deductible

Although it's uncommon to find pet insurance with no deductible, it's essential to know that pet owners can choose from a range of deductible options. Your pet's health, level of comfort with risk, and budget will usually determine the appropriate deductible for you.

To choose the best pet insurance plan for your beloved friend, consider your needs carefully, evaluate coverage from several providers, and speak with your veterinarian. The ultimate purpose of pet insurance is to give you financial security and guarantee that your pet gets the care they require in emergencies.

Do you want to find the best pet insurance?

Let's analyze your pet's breed, age, and location to find the right coverage and the best savings. Ready?

Analyze My PetAbout Pawlicy Advisor

The pet insurance marketplace endorsed by veterinarians, at Pawlicy Advisor we make buying the best pet insurance easier. By comparing personalized coverage and pricing differences we can save you a ton of money, up to 83% in some instances!

Instantly Compare Pet Insurance Plans

Guides

Determine If Pet Insurance Is Worth It

Comparison Charts

Find Your State

Dog Insurance

Licensed Insurance Producer - Pawlicy Advisor

Kari Steere is a licensed P&C insurance agent in all 50 states and has focused entirely on pet insurance since 2019. As an animal lover with a rescued Terrier named Barry, when she's not helping pet owners find the perfect plan on Pawlicy Advisor, she runs a ranch in Oregon and rehabilitates any animals that come across her path.