Bringing home a rescue pet is one of the greatest ways to make a difference in the world. The ASPCA estimates that 6.5 million dogs and cats in need of loving homes enter pet shelters every year.

Shelters are also one of the most popular sources for adopting a new dog or cat. Approximately 23% of dogs are acquired from shelters or humane societies, 20% are acquired from friends or relatives, and 34% are acquired from breeders.

Recently, more pets have been adopted from shelters or entered foster care due to the COVID-19 pandemic. So many families are staying home that they are now available to care for a new dog amid the pandemic.

Most dogs that are acquired from shelters are considered “rescued” because they’ve been adopted after a previous owner abandoned them, or because they were taken into the animal shelter as strays. Rescue dogs often come with a unique history, but the American Veterinary Medical Association (AVMA) insists that homeless animals are no different from their counterparts who come from loving homes.

“These dogs and cats that are in shelters are just dogs and cats. They are not shelter dogs and cats,” says Dr. Amy Marder of the Department of Clinical Sciences at Cummings School of Veterinary Medicine, Tufts University. “Every dog is an individual.”

Rescue dogs will always receive veterinary care when they are taken into a shelter, and they are usually spayed or neutered if they haven’t been already. Still, it helps to know the history of your shelter dog — if that history is available. When signing up for pet insurance, your dog’s age, pre-existing conditions, and their breed can factor into what you’ll pay in monthly premiums.

Surprisingly, many people worry that rescue animals may not be eligible for pet insurance, making pet ownership more complicated. Even if you don’t know your rescue dog’s exact age and history, and even if you don’t have their medical records to show, there’s no need to worry. You can still sign up for pet insurance, and the process is surprisingly simple.

What To Do When You First Get Your Rescue Dog (or Cat)

If you’d like to know the history of your adopted dog or cat, ask the rescue group for a detailed explanation of where they came from before they arrived at the shelter and what medical conditions they have. This information isn’t always available, and it shouldn’t be the deciding factor in whether you adopt or not.

However, it can be helpful to know whether your new pet came from a difficult situation. For example, a shy dog may need extra care and attention before they are comfortable in your home.

The first step to insuring a pet is getting him or her a veterinary examination. This is typically taken care of by the rescue organization, as a physical exam is usually performed as soon as a pet is taken into a shelter. The shelter can then provide you with a detailed report of your dog or cat's overall health.

The vet will estimate your pet’s age if it isn’t known. Any issues that could be considered pre-existing conditions will be documented in the veterinarian’s notes. This helps you (and the insurance companies you request quotes from) understand the health status of your rescue pet.

Although it’s unlikely, if your pet hasn’t received healthcare in a long time, you’ll need to get your new pet a veterinary examination as soon as possible after you adopt them. This is sometimes the case when individual pet parents take in strays or when they adopt a pet from a friend or family member who can no longer care for them. Your dog may also need to be updated in their vaccinations.

Documenting your dog or cat’s health status is perhaps the most important step in adopting a rescue. However, there are some other preparations you’ll need to make when you bring your rescue dog (or cat) home.

Bringing Your Rescue Dog Home

Rescue dogs are just like any other dog, so you’ll need basic dog supplies to take care of your new pet.

Here are just a few things you should have on-hand before you bring your rescue dog home:

- Water and food bowls

- A crate

- A dog bed

- A leash and collar

- Dog tags (including vaccination tags)

- Dog shampoo

- Dog nail clippers

- Waste bags

- A variety of toys and treats

If you’re bringing home a new puppy, you should take steps to “puppy-proof” your home by removing dangerous things from your dog’s area. You may also wish to buy absorbent training pads if you still need to housetrain your pet. Setting up a specific area for your dog and separating it from the rest of your home can help them acclimate to the house more easily.

Even if your dog is older and has already received training, use positive reinforcement to train your dog as soon as you bring them home. Some dogs may lapse in their training when introduced to a new environment due to nervousness. Of course, others adapt to their new home immediately and without many challenges.

Bringing Your Rescue Cat Home

Rescue cats are actually much more common than rescue dogs, but they still need some dediciated prep time and attention.

Make sure to have:

- Water food bowls

- Wet and dry food

- A cat carrier

- Collar and name tag

- A cat bed

- A litter box and litter scoop

- Low-dust (or even better, no dust) litter

- Cat nail clippers

- Scratching post

- A variety of toys and treats

Regardless of whether you're bringing home a new kitten or older cat, you should keep them in a small room at first. You'll also want to remove hiding space options. For example, you can stuff pillow and blankets under the bed to prevent them from using it as a hiding spot. The more a cat is in hiding the longer it will take to become comfortable.

Sit on the floor with the kitten or cat and offer it treats and pets, but be careful not to force anything. Build trust, not fear.

How Pre-existing Conditions May Affect Your Pet Insurance Choices

During your rescue dog or cat’s initial medical examination at the shelter, the veterinarian may determine that your pet has a health condition. From the perspective of an insurance company, this is what’s known as a “pre-existing condition.” That means the health condition was known before you're signed up for pet insurance or before your pet insurance benefits kicked in.

You may already be familiar with the term “pre-existing condition” due to recent debates about human health insurance coverage. While human health plans may cover pre-existing conditions, no pet insurance plans will cover them (however, curable conditions can be covered by some plans after a certain waiting peroid with no recurring symptoms).

Some typical pre-existing conditions in dogs include the following:

- Arthritis

- Urinary blockages

- Cancer

- Ligament problems

- Diabetes

- Heart disease

- Hip dysplasia

- Skin lumps

- Thyroid problems

If your rescue dog or cat has any of these conditions, don’t worry! This does not mean you're ineligible for pet insurance. Pre-existing conditions can’t prevent you from obtaining pet insurance coverage at all.

It just means you won’t be able to get reimbursed for treatment related to your dog's pre-existing condition. Depending on the plan you sign up for, you can get reimbursed for almost every other type of care.

There are a few other ways a pre-existing condition might influence your choice of pet insurance.

Monthly Premiums

Pre-existing conditions don’t always impact your monthly pet insurance premiums because the cost of treating them won’t be covered by your insurance anyway. Your pet’s age, breed, weight, size, and where you live are all factors that influence your monthly premiums.

Your insurer may require you to pay higher monthly premiums if they believe your dog or cat to be in a higher risk category. But, generally, premiums are determined by the factors listed above.

Curable Conditions

Some pet insurance plans will cover curable pre-existing conditions, but only after they’ve been cured and only after your dog orcat has been treatment and symptom-free for several months. For example, ASPCA Pet Health Insurance states that a condition will no longer be considered “pre-existing” if it’s cured and the animal is free of symptoms and treatments for 180 days. There are some exceptions for this policy, however, such as knee and ligament conditions.

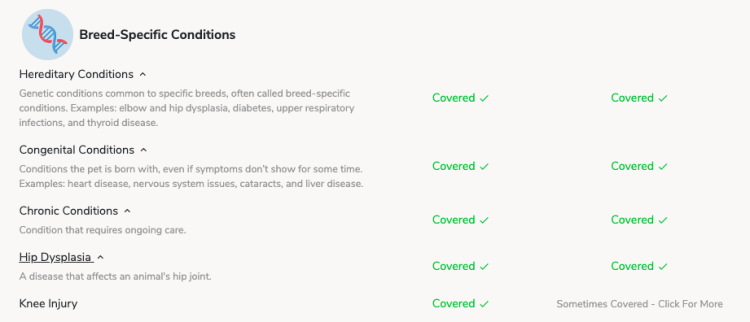

If your dog or cat has a curable pre-existing condition, you may wish to find a plan that includes an exception like this one. You should also ensure your plan covers certain inheritable conditions like hip dysplasia, which may show up later in your dog’s life.

If you use Pawlicy Advisor to compare pet insurance options, just click on a quote, then click on the insurance plan’s “Coverage Details” to see if breed-specific, hereditary, and congenital conditions are covered:

Older Dogs And Cats

An older rescue dog or cat will cost more to insure, regardless of whether they have pre-existing conditions. This is because older pets are more likely to get sick and require treatment. Some insurance providers won’t insure pets over a certain age.

NOTE: When you search for pet insurance plans via Pawlicy Advisor, you start by entering information about your pet, including their age. You can rest assured you’ll only see pet insurance plans your rescue pet can qualify for.

How Pet Insurance Can Improve the Quality of Your Pet’s Life

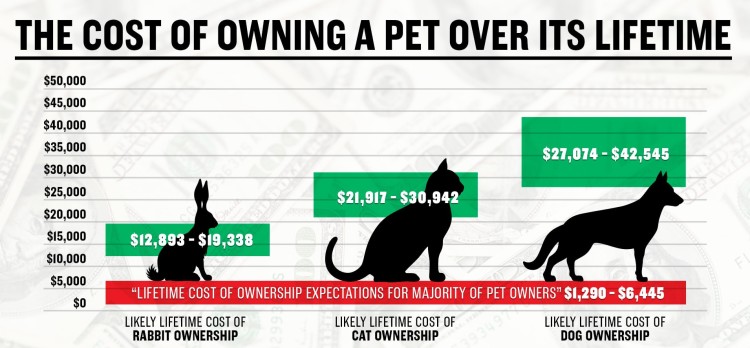

When most pet parents consider pet insurance, they’re weighing the cost of paying their potential vet bills against the monthly costs of their insurance premiums. While it’s true that adding another monthly cost can strain your budget, it’s also true that most pet parents underestimate the lifetime cost of their pets — including the cost of vet bills.

According to one UK report, 98% of pet owners significantly underestimated the cost of owning and caring for a pet. A majority of owners from the study believed their costs wouldn’t go above $6,445. In truth, the lifetime cost of caring for a dog can reach up to $27,000 or higher — even above $40,000.

(Image from CNBC)

Always Get Your Pet the Care They Need

Most pet parents don’t want to consider the idea that they won’t be able to afford their pet’s care if they get sick, but this happens quite often. This is why veterinarians often discuss the costs of care before they provide treatment. It’s also why so many veterinarians offer repayment plans for their clients.

In a worst-case scenario, your pet could need expensive life-saving treatment that you can’t afford. This isn’t a situation any pet owner wants to find themselves in. With pet insurance, you can get peace of mind knowing you’ll be able to afford your pet’s care, even if the worst happens.

Catch Symptoms of Illnesses Early

Pet parents who have pet insurance go to the veterinarian more often because they don’t have to worry about an unexpected expense. But this also provides an additional benefit. More examinations by a veterinarian means more opportunities to catch illnesses early.

Catching the symptoms of an illness early ensures your dog can recover more quickly, and it may also lead to better clinical outcomes. There’s also less chance that you’ll need to pay for an expensive treatment down the road when the illness gets worse.

Get More Wellness Care

While most pet parents opt for either an accident-only plan or an accident/illness plan to cover emergencies, you can also add a wellness coverage component to your pet insurance plan to get reimbursed for routine care. This is completely optional, but it might be a smart move if you anticipate bringing your animal to the vet regularly, or if you have several rescue dogs to care for.

Wellness procedures include physical exams, vaccinations, heartworm tests, fecal tests, and more. Some wellness plans reimburse you to spay, neuter and even microchip your pet.

How to Find the Best Insurance Coverage for Your New Rescue Dog (or Cat)

When looking for a pet insurance policy for your rescue dog or cat, you’ll need to balance what you can afford on your budget with the level of coverage you want. If your rescue dog (or cat) is still young, you can expect lower premiums than if you’re adopting an older pet. But if you’re adopting an older rescue dog or cat, it can be advantageous to insure them, as they might need veterinary care sooner rather than later.

You’ll also need to choose which type of plan works for you. You can save a lot of money by signing up for an accident-only plan, but it won’t reimburse you for the cost of treatment if your dog gets ill. Most pet insurance plans are accident/illness plans, which offer the most comprehensive coverage at the best price.

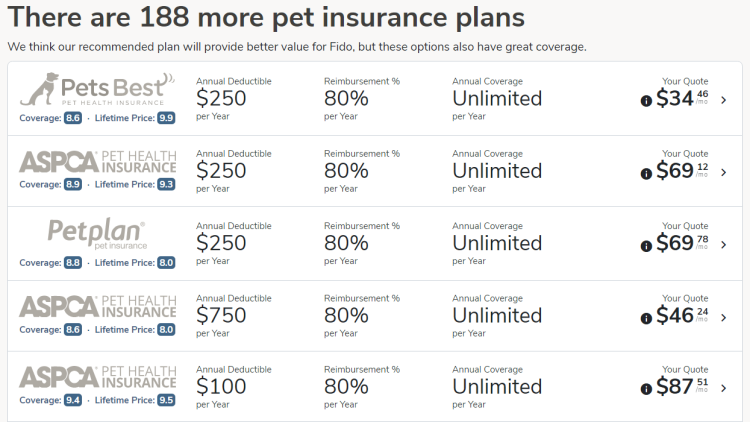

Beyond your monthly premium — the amount you must pay each month to keep your insurance policy active — you should also consider your annual deductible, your reimbursement percentage, and your annual coverage limit per year.

Annual Deductible

Your annual deductible is the amount you must pay out of pocket before your insurance kicks in. You usually want this to be low but selecting a high deductible plan could save you some on your monthly premium.

Reimbursement Percentage

Your reimbursement percentage is the percentage of your veterinary costs your insurance provider will pay you after you pay for treatment. Unlike human health insurance plans, you must still pay upfront for veterinary costs even if you have pet insurance. But you can then submit a claim to your pet insurance provider to be reimbursed — usually no more than two weeks later.

Annual Coverage Limit

Finally, you should pay attention to your annual coverage limit. This is the maximum amount your pet insurance company will reimburse you in a year. Some plans have an “unlimited” annual coverage limit, which means there’s no annual cap to reimbursements.

Compiling all this information is a big challenge on your own. You’d have to contact or search for each provider individually, ask them for quotes, and compare their quotes based on your notes. Thankfully, you don’t have to shop for pet insurance alone anymore.

How Pawlicy Advisor Helps

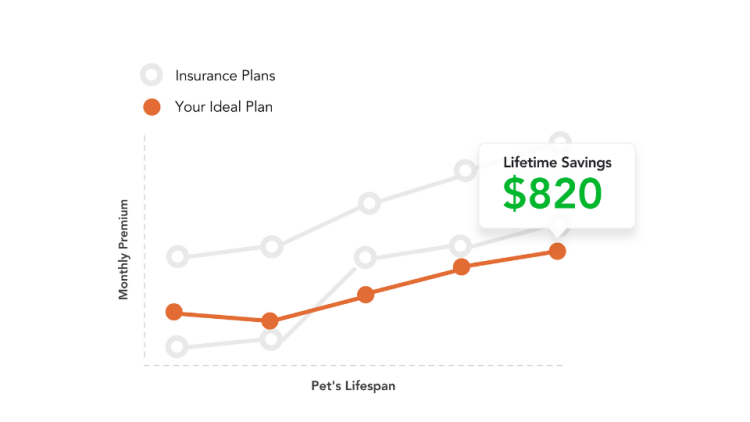

At Pawlicy Advisor, we make finding the right coverage at the right price as easy as possible for you. All you have to do is tell us about your pet, then select the plan that works best for your budget and your desired level of coverage. You can choose between accident-only plans, accident/illness plans, and full coverage plans with a wellness plan add-on. You can even compare premium prices across multiple quotes from top insurance companies at the same time.

Through our partnerships with insurers and veterinary discount providers, we can help you save up to 75% on lifetime costs. We analyze conditions common for each breed and compare prices and exclusions to ensure that all pets, even those who may have preexisting conditions, can be covered by insurance. Pets that can’t be covered by insurance may be eligible for a veterinary discount program.

We also aim to support employees of animal rescue organizations by giving them exclusive employee discounts on insurance for their own pets. We believe that offering access to pet insurance as an employee benefit improves the quality of life for rescue caregivers and their pets. Who better to support than the employees who dedicate their time to helping dogs and cats find loving homes?

If you’re adopting a rescue dog or cat, there’s no reason to wait to shop for pet insurance. With some basic information about your new pet, you can get pet insurance quotes for your rescue dog or cat as well as a personalized recommendation through Pawlicy Advisor today.