Traditional pet insurance companies reimburse you for a percentage of your veterinary costs based on your level of coverage, your limits, and other factors.

But there are other ways to save money on your veterinary expenses. Pet Assure, for example, provides discounts for veterinary care. Pet Assure is not a form of pet insurance, but it can help you save at the vet.

Use the links below to jump to your specific question or read end-to-end for a complete breakdown of Pet Assure pros vs cons.

- What is Pet Assure?

- How does the Pet Assure Savings Program work?

- Is Pet Assure available everywhere?

- How much does Pet Assure cost?

- What's the difference between Pet Assure and Pet Insurance?

- What are customers saying?

- The verdict: is Pet Assure worth it?

First, what is Pet Assure?

Pet Assure is a Veterinary Discount Plan that reduces your overall bill from participating veterinarians. Rather than getting reimbursed for covered vet costs, the Pet Assure program gives you 25% when you show your membership card at checkout.

(Image from Pet Assure)

Pet Assure has no exclusions for in-house medical services. It doesn’t matter how old your pet is, what breed they are, or what type of in-house medical service they receive. It gives you a discount on wellness visits, sick visits, dental cleanings, physical exams, X-rays, and more.

You can even get a discount on treatments and procedures for pre-existing conditions.

The only exclusions to the Pet Assure discount are non-medical services like grooming, outsourced services, medications, and prescription food. The program will only reduce the cost of medical services provided directly by your veterinarian.

The Pet Assure Veterinary Network

Pet Assure relies on a network of participating veterinary practices to provide savings to customers. You can only get a discount from a veterinarian who participates in this network.

If your veterinarian doesn’t participate in the Pet Assure Veterinary Network, you’ll be responsible for the full cost of services - unless you have a pet insurance plan.

Compare Top Pet Insurance Plans

How does the Pet Assure Savings Program work?

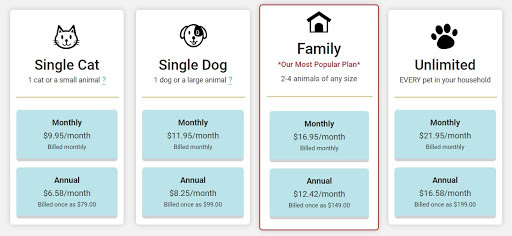

To get Pet Assure, you can enroll your pet online. After providing some basic information, Pet Assure will present you with options for plans. You can select a “Single Cat” plan, “Single Dog” plan, “Family” plan (for 2-4 animals), or “Unlimited” plan (for vet discounts on all household pets). Next, choose between monthly payments or pay for your plan annually at a reduced rate.

Pet Assure will issue you an ID card, which you can get digitally. You can also download Pet Assure’s app to store your digital ID card on your phone. The app is also helpful in finding participating veterinarians in your area.

Once you have your card, you get instant coverage under your Pet Assure plan. There is no waiting period. All you need to do is show your digital or physical ID card to your vet at checkout to get your 25% discount.

(Image from Pet Assure)

Lost Pet Recovery Service

Another perk for signing up is that every member receives a unique ID tag for their pet’s collar. The service is called ThePetTag by Pet Assure.

If your pet is ever lost, anyone who finds them can enter the tag number online to let you know that your pet has been found. You can then scan this database for the pet’s tag number to be reunited with your pet. The person who finds your pet can also contact you or your emergency contacts directly.

It’s estimated that 1 in 3 pets will go lost at some point in their lives, so this is a great free service for any pet parent.

Is Pet Assure available everywhere?

No, you can’t use Pet Assure at every veterinarian. You can only get your discount by going to a veterinarian within the Pet Assure Veterinary Network. There are a decent amount of veterinarians who participate in the network, and the company says there are Pet Assure veterinarians in all 50 U.S. states.

How much does Pet Assure cost?

The costs for Pet Assure may vary based on location, your pet’s size, and how many pets you’d like to cover. Based on Pawlicy Advisor’s analysis, Pet Assure’s prices start at about $6.50 per month and go up to about $22.00 per month.

(Image from Pet Assure)

You can save on monthly costs by agreeing to an annual plan, billed once per year as a lump payment. For example, if you’d like to sign up for a Family plan, you might pay $149.00 for an entire year (equal to $12.42 per month) instead of paying $16.95 per month in regular payments.

What’s the difference between Pet Assure and pet insurance?

Pet Assure is not a pet insurance plan. Instead, it is a broad discount applicable to all in-house veterinary services at participating veterinary practices.

Unlike traditional pet insurance, there are no waiting periods for Pet Assure, so you can start saving the moment you sign up. Pet Assure also doesn’t limit coverage for pre-existing conditions like traditional pet insurance. As long as you’re paying for in-house veterinary services at a participating vet, you can get a discount.

The key difference between Pet Assure and pet insurance is the amount of money you can save. Many pet insurance plans often cover up to 90% of the costs of covered expenses, whereas Pet Assure only gives you a 25% discount for all veterinary services.

No Deductibles, Claims, or Exclusions

Unlike traditional pet insurance, Pet Assure has no deductibles or annual limits. You don’t have to pay out of pocket up to a certain amount each year before you start saving on veterinary expenses. You’ll never lose your discount, no matter how many times you visit the vet.

There is no process for claims, either. Instead of submitting a reimbursement claim after paying for veterinary services, you can get a slightly lower upfront out-of-pocket cost on all your veterinary services.

There are also no exclusions for what veterinary services are covered. If you are paying for medical services received in-house by your veterinarian, you can claim your 25% discount. Many pet insurance companies may have age and breed restrictions on their coverage, but that isn’t the case with Pet Assure.

Most importantly, you can still get your 25% discount for the treatment of pre-existing conditions.

Example Cost/Value Comparison

Pet Assure might be a great option for many pet parents, but it depends entirely on your circumstances and the needs of your animals.

For example, for $9.95/mo Pet Assure gives you a 25% discount at a participating vet:

-

If your cat eats something they shouldn’t (e.g., plastic), and your vet happens to participate in the program, then an $800 vet bill only costs you $600

-

If your vet isn’t “in-network,” you’ll be responsible for the total $800

Alternatively, for $12.95/mo, a pet insurance plan can reimburse you for 90% of the cost after your deductible is met:

-

If your cat eats plastic, and you have a 90% reimbursement with a $200 annual deductible, then an $800 vet bill only costs you $260

-

With pet insurance, there is no network to worry about, and the next unexpected cost will fully take advantage of the 90% reimbursement because your deductible is already paid for the year

What are customers saying?

Pet Assure has an A+ rating with the Better Business Bureau (BBB) and has been an accredited business since 2016. Customer reviews on the BBB website give Pet Assure 3.67 out of 5 stars, but that’s an average based on only 3 customer reviews at the time of this writing. Trust Pilot reviewers give Pet Assure 3.6 out of 5 stars at the time of this writing.

Positive reviews say that it is easy to use, convenient, and provides good value for a small investment. Some also mention they’ve been Pet Assure customers for years and that the service pays for itself quickly each year.

Negative reviews say they have faced challenges when trying to get their discounts, even at veterinarians in the Pet Assure Veterinary Network. In some cases, the veterinarian told them to send a bill to Pet Assure for reimbursement, but that isn’t how the service works. Others say they weren’t made aware that they needed to present their card to get a discount, so they couldn’t take advantage of their membership.

Some negative reviewers believe the money they pay for the service isn’t worth it because the discount isn’t high enough.

Here’s What We Like About It

One of the biggest benefits of Pet Assure is that it can discount treatments and procedures for pre-existing conditions, which isn’t true of any pet insurance plan. If your pet has a pre-existing condition, Pet Assure is probably one of your best options for saving on their care.

Having no claims process or waiting period, and not worrying about meeting your deductible to save on costs is also much appreciated.

Pet Assure pros:

-

Flat 25% discount

-

No annual deductible

-

No claims

-

No waiting periods

Concerns To Be Aware Of

Pet Assure can only be used at veterinary clinics that accept it, so this will limit your choice of veterinarians.

If there isn’t a veterinarian near you who accepts Pet Assure, you’re out of luck.

On its own, Pet Assure won’t do much to protect you from the highest veterinary costs. A 25% discount is great, but if you’re facing a $4,000 vet bill, you’ll still have to pay $3,000 out of pocket. It also will not discount outsourced specialist services, medications, or prescription food, which some pet insurance plans can cover.

Finally, some customers have complained that they have had trouble getting their discount. It’s important to present your Pet Assure card the moment you pay your veterinarian. Discounts can’t be applied after the fact, and Pet Assure won’t reimburse you for any of your vet expenses.

Pet Assure cons:

-

Only some vets are “in-network”

-

Unexpected vet bills can easily cost over $1000+, so a 25% discount is not as helpful as a 90% reimbursement

-

If you don’t have your ID card, you won’t get the discount, and you can’t get reimbursed later

The verdict: is Pet Assure worth it?

If you have an older pet with pre-existing conditions, Pet Assure is likely your best option to save money on veterinary care - just make sure your veterinarian is in Pet Assure’s network before signing up.

Alone, Pet Assure won’t protect you much from the highest veterinary costs. Since 1 in 3 pets will need emergency treatment in any given year, this should be a major consideration. If your pet needs expensive care like surgery, you could still be responsible for thousands of dollars over the course of their lifetime.

You could potentially get the best of both worlds by using Pet Assure as a supplement to a traditional pet insurance plan covering 80% to 90% of eligible veterinary costs. This is an especially worthwhile consideration for pets with pre-existing conditions.

Even for pets without pre-existing conditions, Pet Assure could also be seen as an alternative to a wellness plan add-on.

NOTE: Some pet insurance plans won’t allow you to combine their coverage with other discounts, so you may need to choose one or the other when it comes time to pay your vet. In most cases, you’ll want to use pet insurance and opt for Pet Assure only when paying for routine care or a pre-existing condition.

Key Takeaways

- Pet Assure offers members 25% off pet medical bills at participating veterinarians, versus the 90% reimbursement rate offered by many pet insurance providers.

- You can enroll your pet online for same-day coverage, no matter their age or health condition, with various plan and payment options.

- Pet Assure is limited to vets in-network, requires an I.D. card at the time of checkout, and may not provide significant discounts on expensive medical services.

- Some pet owners complement their pet insurance policy with a Pet Assure savings plan for savings on treatments related to pre-existing conditions.