How to Choose Pet Insurance

Reviewed by Kari Steere, Licensed Insurance Producer

Updated: Jun 25, 2025

Struggling to compare pet insurance plans? Not sure which coverage you really need or what’s a good price? Wondering which pet insurance is best? Too many providers to choose from? We understand — we’ve partnered with several top pet insurance companies to finally bring transparency to pet parents and make choosing the right pet insurance 100 times easier.

Compare Top Pet Insurance Companies Side-by-Side

Use Pawlicy Advisor to get personalized quotes from leading brands and see how each plan stacks up — instantly.

100% free to use. No fees. No commitment.

Whether you're looking for the best dog insurance or the best cat insurance, we will help break this down in a way that everyone can understand with our pet insurance comparison below (because our pets’ health may depend on it).

How to Choose Pet Insurance for Dogs and Cats

You should choose pet insurance by first identifying the right coverage tier: accident-only, accident-and-illness, or add-ons for wellness and dental care. Compare quotes using tools like Pawlicy Advisor.

Check deductibles, payout limits, reimbursement rates, and rising premiums. Review exclusions, waiting periods, and claim speed. Prioritize stable providers, not just low rates. Enroll early for the best coverage.

There’s a lot to think about when shopping for a pet insurance plan. You don’t want to pay a high average cost for coverage you don’t need, but you don’t want to pay too little and find yourself in a tough spot financially when your pet gets sick.

Costs and Coverage

The cost of pet insurance directly impacts your coverage. In terms of price variables, there are four factors you need to pay attention to:

- Annual Deductible

- Reimbursement Rate

- Annual Limit

- Monthly Premium

Enter your zip code to see how much pet insurance will cost for you.

Instant results. No spam. 1M+ pet parents served.

4.9 stars across hundreds of reviews

Annual Deductible in Pet Insurance

Your annual deductible is the amount you must pay out of pocket before your pet insurance kicks in. So, if your first vet bill of the year is $500 and your annual deductible is $500, you’ll have to pay the full $500. You’ll be reimbursed a percentage of every other covered expense for the rest of the year

Annual Limit in Pet Insurance

The Annual coverage limit is a cap on the amount you’ll receive in reimbursements from your insurance provider each year. Many pet insurance plans have unlimited annual coverage, so there is no cap. However, some plans will only provide reimbursement up to a certain amount, such as $15,000 per year.

Monthly Premium in Pet Insurance

Finally, your monthly premium is how much you pay each month to keep your plan active. Most pet parents want a low monthly premium because it won’t add as much to their monthly bills. Keep in mind that lower insurance premiums usually mean lower rates of coverage.

NOTE: Premiums will increase over time as your pet ages, so understanding how much you can expect the premium to increase is an important factor in total cost.

You can use Pawlicy Advisor to scan the fine print in policy variations across top pet insurance companies to understand which plan is best in terms of lifetime costs vs. coverage value.

Other Factors

Of course, there are other factors to look at when selecting insurance. You can read customer reviews of specific pet insurance companies to find out if their customer service is top-notch.

Do keep in mind that reviews can skew your perception, as many negative reviews may simply be the result of a bad fit rather than a bad product (which is why the Pawlicy Advisor’'s pet insurance comparison tool personalizes recommendations based on breed and cost data, not random reviews).

If you want to be sure you’ll get reimbursed quickly, you can shop providers based on their average reimbursement speeds. You may also want to consider the pet insurance company’s history or even what initiatives they have in place to help animals in need.

Companies That Offer Pet Insurance For Dogs and Cats

There are over 20 pet insurance companies in North America, according to the North American Pet Health Insurance Association (NAPHIA). You might already be familiar with companies like the ASPCA and Trupanion.

Use the links below to find extensive guides detailing everything you need to know about pet insurance plans offered by the following companies:

Recommended Reading: Best Pet Insurance Providers to Consider in 2025

Top Pet Insurance Companies

Pet insurance isn’t one-size-fits-all. Whether you’re looking for fast claim reimbursements, preventive care coverage, or tech-savvy tools, each provider in our list brings something different to the table.

Here’s a closer look at some of the most reputable names in the pet insurance industry today.

ASPCA® Pet Health Insurance

The ASPCA is the American Society for the Prevention of Cruelty to Animals, a non-profit organization founded in 1866. It was the first humane society established in North America.

ASPCA Pet Health Insurance covers accidents, illnesses, and other health issues in dogs and cats through its Complete Coverage℠ plan. You can also include preventive care coverage as an addon feature.

Embrace® Pet Insurance

Embrace Pet Insurance is recognized by Forbes as one of the top pet insurance providers. The company reports that it paid more than $212.5 million in claims in 2024, with 92% of all claims covered. After a six-month waiting period, Embrace covers dental illnesses, congenital conditions, and orthopedic conditions.

Fetch Pet Insurance

Formerly known as Petplan, Fetch is the largest pet insurance provider in the world and has operated in the U.S. since 2006. The company offers flexible pet insurance policies that cover the cost of medical treatment for unexpected illnesses and injuries. All domestic dogs and cats in the U.S. and Canada are eligible for coverage through their plans, provided their age falls within the enrollment requirements.

Figo Pet Insurance

Figo was founded in 2013 by Rusty Sproat. It has since become one of the largest pet insurance providers in the market and has won multiple awards for its coverage.

The key feature of Figo Pet Insurance is the optional 100% reimbursement rate that pays for all vet costs covered by your policy after you've met your deductible. You'll get comprehensive Accident & Illness coverage with any policy you choose, including both their lower- and higher-tiered plans.

Hartville Pet Insurance

Founded in 1997, Hartville is one of the longest-operating insurance companies in the U.S. The brand has a long history of prioritizing community outreach and supporting animal charity organizations.

Hartville provides insurance plans for cats and dogs, covering your pet’s unexpected veterinary bills and treatment costs. All domestic dogs and cats in the U.S. (aside from exotic pets) are eligible for the Hartville Complete Coverage plan.

Lemonade Pet Insurance

Before they began offering coverage for pets in last few years, Lemonade was known for its innovative approach to home, renters, and auto insurance products. The company harnesses the power of technology to bring you a simple app where you can manage your plan and file claims, 50% of which are instantly approved.

MetLife Pet Insurance

MetLife recently acquired PetFirst, which became one of the fastest-growing administrators of pet health insurance in North America after its founding in 2004. The company continues to offer health insurance coverage for all pet parents with several favorable coverage options.

Pets Best Pet Health Insurance

Pets Best Insurance Services was founded in 2005 by Dr. Jack Stephens, who launched the first pet insurance company in North America. Many of the people who work at Pets Best Insurance have a veterinary background and are involved in animal rescue.

Pets Best Pet Insurance offers fast claim reimbursement, typically in five days or less, as well as the option to pay your vet directly. The company offers plans for dogs and cats that cover unexpected vet bills and treatment costs for injuries, illnesses, and other health issues.

Pumpkin Pet Insurance

Pumpkin is newer company founded by Zoetis, one of the largest animal health company in the world, in 2018. They offer comprehensive coverage for dogs and cats, and have a strong focus on preventive care.

Their plans are straightforward and a team of veterinary professionals helped inform the coverage model, ensuring adequate coverage for the most common conditions in pets

How to Compare Pet Insurance Plans

You can compare pet insurance plans effectively by researching coverage and pricing based on your breed, location, and budget.

Use a spreadsheet to track quotes from each provider. – or make it easy and use Pawlicy Advisor to compare quotes from top providers side-by-side and get matched to the right plan.

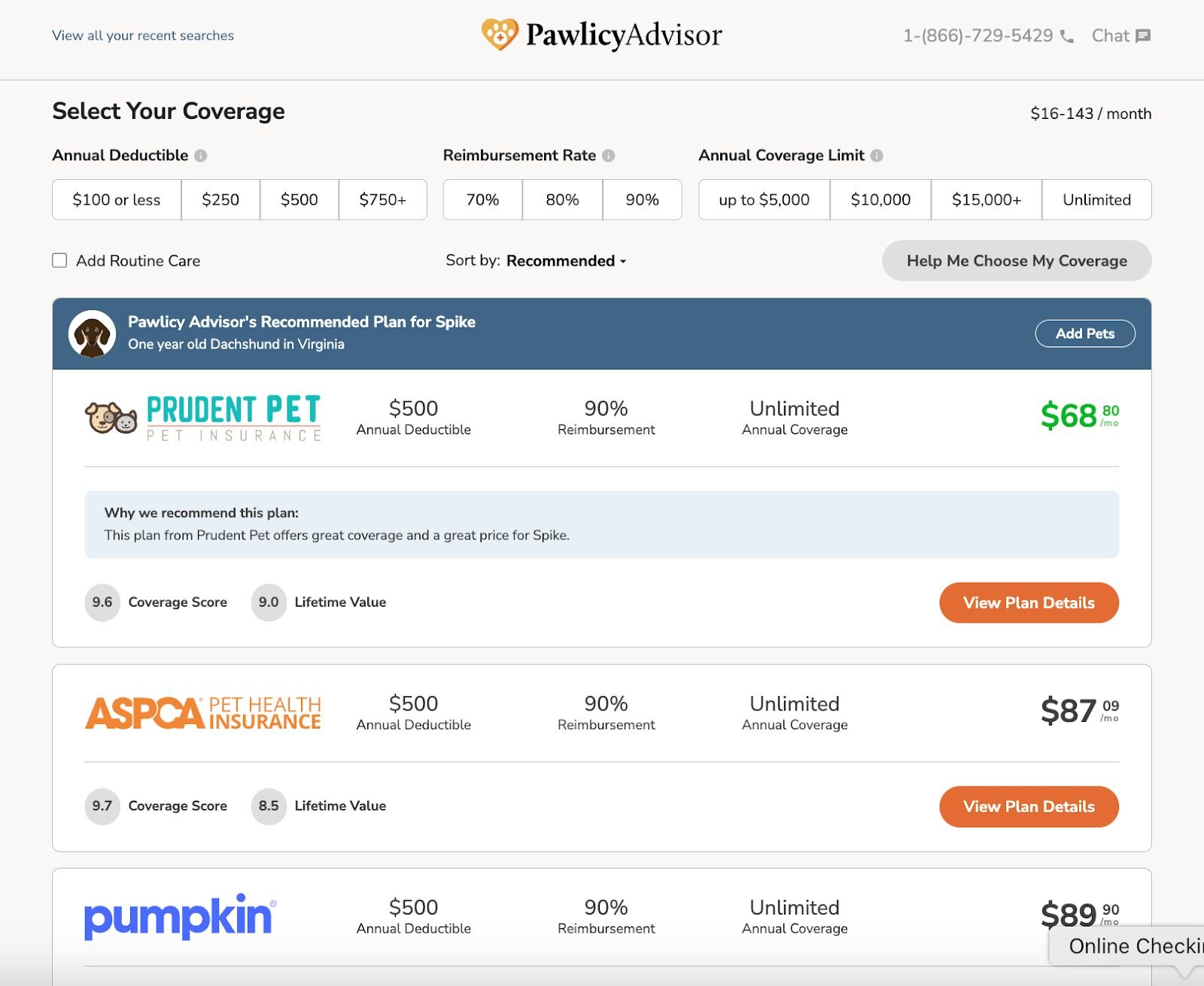

Just enter a few details about your pet in Pawlicy Advisor’s free comparison tool, like age, zip code, and breed to easily compare top pet insurance plans and see personalized recommendations in one place.

Pawlicy Advisor will instantly analyze options for you across top providers simultaneously.

You’ll receive a data-driven recommendation based on your pet’s breed risks, location, lifetime cost expectations, and more.

Below your top recommended plan, you’ll see a long list of additional quotes to browse through in a matter of seconds, and you’ll be able to choose the best plan for your pet based on monthly cost, reimbursement percentage, annual coverage rate, and more.

There are several options to sort your results, too. You can sort quotes by best recommendation, lowest cost, best lifetime cost, and/or best coverage.

You can filter your results by annual deductible, reimbursement percentage, and rate of coverage. If you have a specific provider brand in mind, you can search for their plans exclusively.

Once you see a plan you like, just click on the quote to get more details. You can see what is covered and what isn’t, as well as the Pawlicy Advisor "Coverage Score” and "Lifetime ValuePrice Score" (which ranks plans based on how comprehensive their coverage is for your specific pet and how much we expect each plan to increase in price over your pet's lifetime).

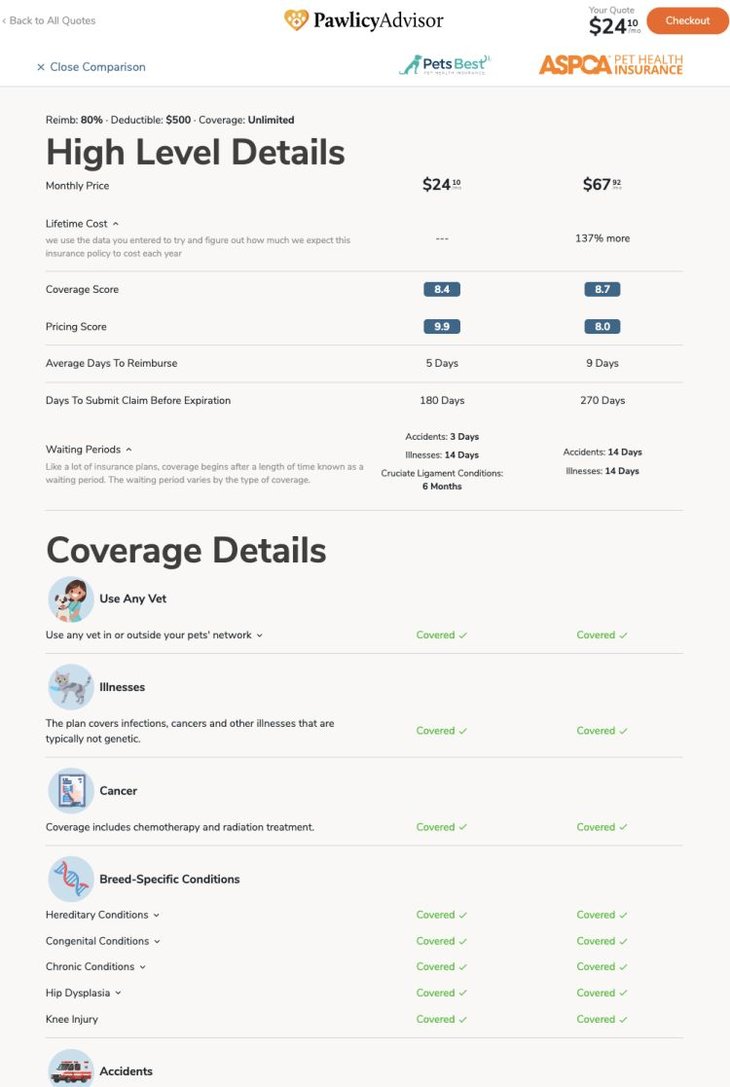

Create a custom comparison chart, the smart way

After talking to many pet parents, it's clear that people wanted a solution to compare their recommended plan and other interesting options quickly and easily from within a comparison chart.

This makes a lot of sense. There's just so much information to digest; the easiest way to simplify the comparison process is to view plans side by side - highlighting key differences in pricing and coverage.

So, we upgraded the Pawlicy Advisor tool to help pet parents generate custom pet insurance comparison charts on the fly.

The above screenshot is just a fraction of what you can learn by comparing pet insurance at Pawlicy Advisor.

In total, you'll be able to compare costs and the following coverage details side-by-side:

- Illnesses

- Cancer

- Accidents

- Breed-specific conditions

- Dental treatments

- Alternative therapies

- Behavioral issues

- Prescribed foods and medications

- Exam fees

- Poison consultation

- Supplements

- Stem cell therapy

- LASER therapy

- Lost pet advertising

- Cremation or burial

- and more…...

Purchasing your ideal plan

Once you're confident that the plan is the best fit for you at the right price, you'll want to purchase your pet insurance through Pawlicy Advisor.

- It's free.

- You'll gain peace of mind that you've made the right choice by comparing real-time quotes from top providers simultaneously.

- You'll see important alerts about breed-specific coverage needs, ensuring your chosen plan is indeed the best plan for your unique pet.

- You can customize the plan and see actual price changes instantly (see video below).

- Exact same price as buying direct - but less hassle.

Compare Top Pet Insurance Companies Side-by-Side

Use Pawlicy Advisor to get personalized quotes from leading brands and see how each plan stacks up — instantly.

100% free to use. No fees. No commitment.

Types of Pet Insurance Plans

There are three central pet health insurance types you can consider:

- Accident-Only Plans

- Accident and Illness Plans

- Pet Wellness Plans

The cheapest plans only cover accidents. But a comprehensive pet insurance plan usually covers accidents, illnesses, breed-specific conditions, dental needs, and prescribed medications.

Most plans also provide the option to add a wellness or preventive care component for an extra cost. This typically covers routine veterinary care like tests and exams up to a certain amount.

What Each Pet Insurance Policy Covers

It can be a bit confusing to understand the differences between “accident” coverage, “illness” coverage, and “wellness” coverage.

Accident-Only Coverage

Accident coverage reimburses costs for treatments related to physical injuries, including some exam fees. It typically covers X-rays and other procedures necessary to diagnose and treat injuries, such as broken bones.

Accident & Illness Coverage

Accident and illness coverage reimburses costs for injuries, infections, cancers, and most non-genetic illnesses. It also often includes coverage for chronic conditions, congenital issues, and breed-specific genetic disorders, such as hip dysplasia.

Wellness and Preventive Care Coverage

Wellness coverage is an optional add-on that reimburses routine care costs, such as exams, deworming, and preventive tests. It benefits pet owners who schedule annual vet visits and is especially helpful for new puppy parents.

Dental Coverage

Teeth cleanings and dental X-rays are often covered as part of a wellness add-on, but you can also obtain dental coverage as part of an accident/illness plan. Dental coverage will cover costs associated with tooth extractions and cleanings related to dental illnesses, such as periodontal disease and others.

Prescribed Medication Coverage

Prescription medication coverage covers some of the costs of any medicines your vet prescribes. It may also cover the costs of prescription foods if your pet needs them because of a health condition.

Finding the Right Plan for Your Dog or Cat

Comparing dog insurance plans or cat insurance plans doesn’t have to be difficult.

Use Pawlicy Advisor to instantly analyze hundreds of policies and create pet insurance comparison charts.

We want to help pet parents do the right thing because no pet should have to suffer due to unaffordable treatment costs.

Frequently Asked Questions

We match you with the right pet insurance that covers what matters most, at no cost to you–almost instantly. Our platform analyzes your pet’s info to help you compare hundreds of quotes across top companies and highlights unique advice tailored to your pet’s breed. Pet owners can compare plans, customize policies to fit their budget, and enroll in the right coverage all in one place.

Our licensed agents are not biased toward any one insurer, so you can get objective guidance. Feel free to call us at (866) 729-5429 or email us at info@pawlicy.com.

See which pet insurance is right for your best friend.

Do you want to find the best pet insurance?

Let's analyze your pet's breed, age, and location to find the right coverage and the best savings. Ready?

Analyze My PetAbout Pawlicy Advisor

The pet insurance marketplace endorsed by veterinarians, at Pawlicy Advisor we make buying the best pet insurance easier. By comparing personalized coverage and pricing differences we can save you a ton of money, up to 83% in some instances!

Instantly Compare Pet Insurance Plans

Guides

Determine If Pet Insurance Is Worth It

Comparison Charts

Find Your State

Dog Insurance

Pawlicy Advisor is the #1 pet insurance marketplace in the U.S. Recommended by veterinarians. Trusted by 1M+ Americans. Our team of veterinary advisors and licensed insurance experts are dedicated to helping pet parents give their dogs and cats the best possible care.