How Much Pet Insurance Costs in 2025: Compare Quotes by Breed and State

Reviewed by Kari Steere, Licensed Insurance Producer

Updated: Jun 27, 2025

Vet bills have skyrocketed 60% or more over the past decade.1 The right pet insurance plan can protect your wallet—and your pet—when it matters most. But how much does pet insurance cost? The answer depends on your pet’s breed, age, and where you live.

Enter your zip code to see how much pet insurance will cost for you.

Instant results. No spam. 1M+ pet parents served.

4.9 stars across hundreds of reviews

Key Takeaways

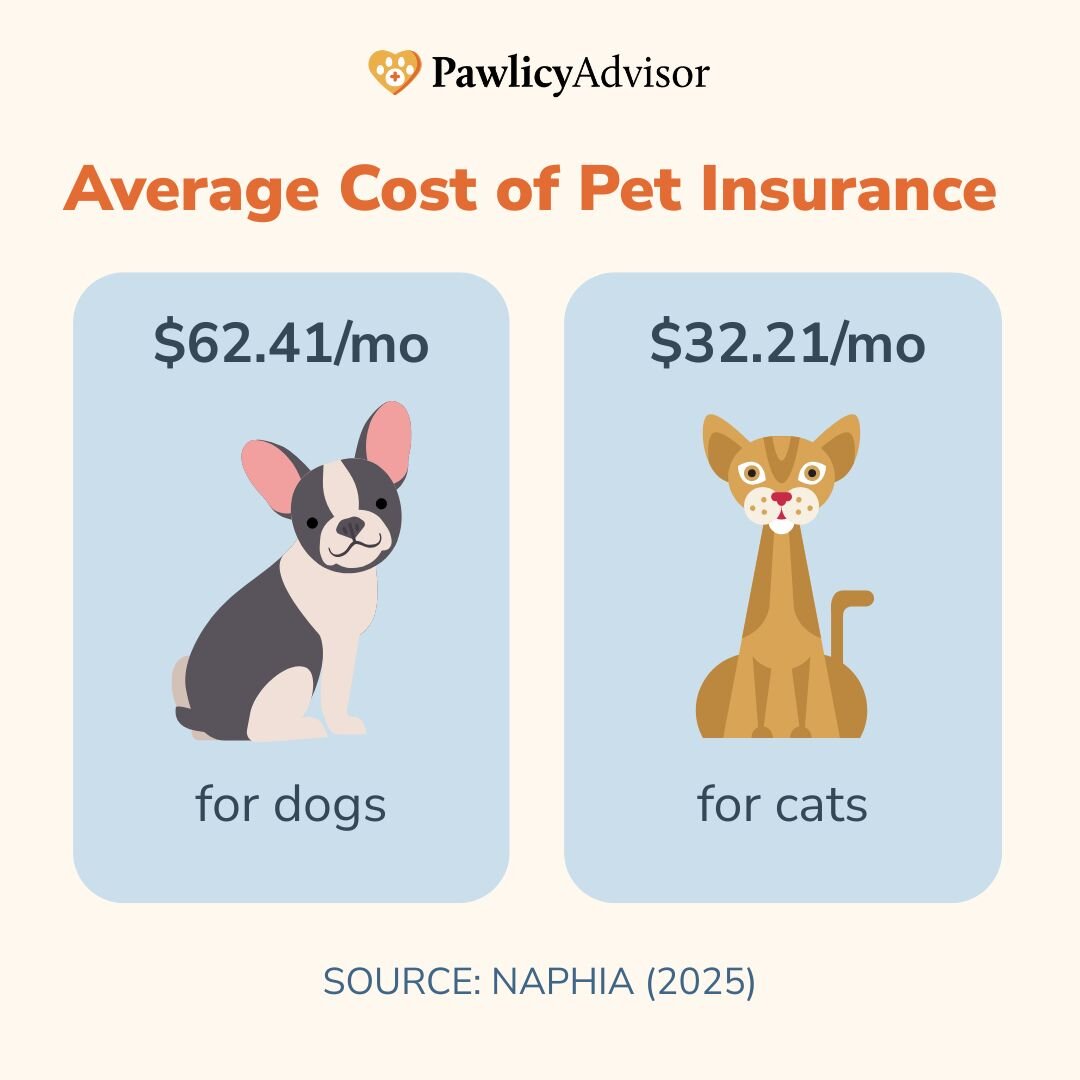

- Average Cost: $62.44/month for dogs and $32.21/month for cats.

- Expected Range: $37.18 - $72.99/month for dogs and $23.84 - $49.76/month for cats

- Price Factors: Breed, age, location, insurer/carrier, coverage terms

- Value: Reduces the financial risk of expensive, unexpected vet bills.

- How to Save: Compare quotes from top companies, tailored to your needs, with Pawlicy Advisor.

As the #1 pet insurance comparison site recommended by veterinarians, Pawlicy Advisor has access to real-time cost data from top companies, and we’ve analyzed thousands of real pet insurance quotes across the country—so you don’t have to.

✔️ Reviewed by a Licensed Pet Insurance Expert

✔️ Updated for 2025 with the latest pricing trends

✔️ Data compiled from thousands of real customers

Jump to the section that matters most to you below

- Average Pet Insurance Costs at a Glance (2025 Data)

- How Much is Full Coverage Pet Insurance?

- Why Pet Insurance Isn’t Right For Everyone, But Could Be Right For You

- Factors That Affect Pet Insurance Prices

- Cost Factors You Can (and Can’t) Control

- How to Save on Pet Insurance Without the Headache

- Frequently Asked Questions

Average Pet Insurance Costs at a Glance (2025 Data)

The average cost of pet insurance for dogs with accident and illness coverage in the U.S. is $62.44 per month ($749.29 per year). For cats, the average monthly cost is $32.21, according to the North American Pet Health Insurance Association 2

More specifically, looking at the hundreds of thousands of Americans who used Pawlicy Advisor to compare quotes across top pet insurance companies in 2024, we found that the average range (25th percentile to 75th percentile) for dogs and cats is:

Monthly | Annual | |

|---|---|---|

Dogs: | $37.18 - $72.99 | $446.16 - $875.88 |

Cats: | $23.84 - $49.76 | $286.08 - $597.12 |

There are massive differences in costs depending on your pet’s breed, age, location, coverage, and more, so while averages can provide some insight, the best way to save on insurance costs is to compare quotes personalized to your pet’s unique needs.

* For data tables and averages by breed, age, and location, scroll down to our FAQs.

What Does Pet Insurance Cover?

Pet insurance coverage depends on the type of plan you choose.

- Accident-only plans cover emergency care for physical injuries like broken bones, cuts, burns, or if your pet is hit by a car. They don’t cover illnesses or breed-related conditions.

- Accident and illness plans are the most popular option (about 98% of plans). They cover both injuries and unexpected illnesses such as infections, parasites, hip dysplasia, and even dental disease (like tooth extractions). However, they don’t cover preventive care or pre-existing conditions.

- Wellness plans are add-on riders that cover routine care, such as checkups, vaccines, and annual exams, but not emergencies or illnesses.

To sum up, pet insurance may cover:

- Accidents (e.g., broken bones, swallowed objects)

- Illnesses (e.g., cancer, parvovirus, hip dysplasia)

- Surgeries (e.g., torn ligaments, cataracts)

- Medications

- Diagnostics (e.g., X-rays, MRIs, blood tests)

- Emergency exam fees

Again, most plans don’t cover pre-existing conditions. That’s why it’s important to insure your pet as soon as possible, so they can get maximum protection from their policy.

How Much is Full Coverage Pet Insurance?

According to 2024 data from the North American Pet Health Insurance Association (NAPHIA):

- For dogs, accident & illness pet insurance policies cost an average of $749.29 per year.

- For cats, accident & illness pet insurance policies cost an average of $386.47 per year.

How Much is a Vet Visit for a Dog Without Insurance?

DISCLAIMER: Prices depend on the type of visit (general, emergency, or specialist), your location, your pet’s age and health, and any extra services like vaccines, tests, flea treatments, nail trims, or dental care.

Treatment or Service | Cost Estimate |

|---|---|

Emergency exam | $100–$200 |

Blood test | $80–$200 |

Pain medication | $40–$80 |

Wound care | $800–$2,500 |

X-ray | $150–$250 |

Foreign body removal | 3,000–$4,000 |

Short hospitalization | $600–$1,700 |

Long hospitalization | $1,500–$3,500 |

Bloat treatment | $1,000–$5,000 |

Source: Preventive Vet and CareCredit

How Much is a Vet Visit for a Cat Without Insurance?

DISCLAIMER: Prices depend on the type of visit (general, emergency, or specialist), your location, your pet’s age and health, and any extra services like vaccines, tests, flea treatments, nail trims, or dental care.

Treatment or Service | Cost Estimate |

|---|---|

Emergency exam | $100–$200 |

Blood test | $80–$200 |

Urine test | $40–$70 |

Ultrasound | $300–$600 |

X-ray | $150–$250 |

Abscess care | $300–$1,500 |

Hospitalization | $600–$3,500 |

IV catheter and fluids | $120–$170 |

Source: Preventive Vet and CareCredit

Why Pet Insurance Isn’t Right For Everyone, But Could Be Right For You

First, pet insurance may not be the right solution for every pet owner. Some people may not be able to afford any added cost to their monthly expenses. Some people have very old pets with multiple pre-existing conditions. Considering these factors is important when evaluating your options for pet coverage and researching various insurance providers.

However, if you can budget for the cost of coverage and your pet is in relatively good health, pet insurance is a smart way to get peace of mind, knowing that you’ll be reimbursed for unexpected vet bills that could easily add up to thousands of dollars.

Here’s what we know:

- 1 in 3 pets need emergency treatment in any given year

- Without pet insurance, veterinary treatment in any given year could range from $0 to $10,000+

- With pet insurance, veterinary treatment in any given year will be closer to the annual insurance premium (eg, $675.61/year on average for dogs)

EXAMPLE VET COSTS: Before and After Reimbursements

Veterinary Treatment | Cost | Total* with Insurance |

|---|---|---|

Anesthesia | $225 | $22.50 |

Abdominal Exploratory | $2,200 | $220 |

Hospitalization | $250 | $25 |

Pain Injection | $225 | $22.50 |

Antibiotic Injection | $225 | $22.50 |

EKG/Pulse, Ox/CO2/Temp/BP | $25 | $2.50 |

Operating Room Fees | $10 | $1 |

Fluids IV | $90 | $9 |

Hazmat Disposal Fee | $5 | $0.50 |

Take-Home Meds | $150 | $15 |

TOTAL: | $3,405 | $340.50 |

*After deductible is met, based on a 90% reimbursement rate.

Nearly half of pet owners underestimate the cost of care over their pets’ lifetime.3

One of the biggest benefits of pet insurance? It helps you plan for your pet’s care, so when the unexpected happens—an injury, an illness, or an emergency vet visit—you don’t have to hesitate.

Still not sure if pet insurance is right for you? Take the quiz and find out.

Instant results. No spam. 1M+ pet parents served.

What Determines Pet Insurance Prices?

The price you pay for pet insurance depends on a variety of factors. Some are out of your control (like your pet’s breed, age, and location), while others can be adjusted to fit your budget (like your deductible, reimbursement rate, and payout limits).

Cost Factors You Can (and Can’t) Control

Cost Factor | Can You Control It? |

|---|---|

Breed Health Risks | ❌ No |

Age of Pet | ❌ No |

Location | ❌ No |

Insurer/Carrier | ✅ Yes |

Plan & Coverage Type | ✅ Yes |

Deductible | ✅ Yes |

Reimbursement Rate | ✅ Yes |

Payout Limit | ✅ Yes |

Billing Schedule (Monthly vs. Annual) | ✅ Yes |

✅ Yes |

Remember...

- Some breeds have higher medical risks, which translates to more expensive policies.

- Older pets cost more to insure than younger pets.

- Where you live matters—areas with higher veterinary costs will have higher insurance costs.

- You can lower the cost by customizing your policy, changing the deductible, reimbursement rate, and more.

Click the button to find a plan that fits your budget and coverage needs

Instant results. No spam. 1M+ pet parents served.

How to Save on Pet Insurance Without the Headache

Pet insurance can feel overwhelming—but finding the right coverage at a great price doesn’t have to be.

Instead of manually comparing dozens of plans, filling out forms on multiple websites, and sorting through confusing fine print, you can let Pawlicy Advisor do the work for you.

Here’s how we make saving on pet insurance simple:

✅ One Easy Form – Fill out one form and instantly compare 100+ policies.

✅ Personalized Matchmaking – Get personalized recommendations based on your pet’s breed, age, and medical risks.

✅ Find the Best Price – Sort plans by lowest cost, best coverage, or lifetime value.

✅ No Extra Fees – You pay the same price as buying direct but with expert guidance.

Want the lowest price? The most coverage? A balance of both?

We make it easy.

Instant results. No spam. 1M+ pet parents served.

Pawlicy Advisor is America’s #1 pet insurance marketplace recommended by veterinarians nationwide. We take the guesswork out of pet insurance and match you with the right plan for your pet in minutes. Over 1 million pet owners have trusted us. You should too.

Frequently Asked Questions

We match you with the right pet insurance that covers what matters most, at no cost to you–almost instantly. Our platform analyzes your pet’s info to help you compare hundreds of quotes across top companies and highlights unique advice tailored to your pet’s breed. Pet owners can compare plans, customize policies to fit their budget, and enroll in the right coverage all in one place.

Our licensed agents are not biased toward any one insurer, so you can get objective guidance. Feel free to call us at (866) 729-5429 or email us at info@pawlicy.com.

Compare Top Pet Insurance Companies Side-by-Side

Use Pawlicy Advisor to get personalized quotes from leading brands and see how each plan stacks up — instantly.

100% free to use. No fees. No commitment.

References:

- https://www.nytimes.com/2024/06/23/briefing/the-costs-of-caring-for-pets.html

- https://naphia.org/industry-data/section-3-average-premiums/

- https://www.carecredit.com/providers/insights/pet-lifetime-of-care-study/

- https://www.preventivevet.com/pet-emergency-statistics

- https://www.carecredit.com/vetmed/costs/#average-state-costs

Do you want to find the best pet insurance?

Let's analyze your pet's breed, age, and location to find the right coverage and the best savings. Ready?

Analyze My PetAbout Pawlicy Advisor

The pet insurance marketplace endorsed by veterinarians, at Pawlicy Advisor we make buying the best pet insurance easier. By comparing personalized coverage and pricing differences we can save you a ton of money, up to 83% in some instances!

Instantly Compare Pet Insurance Plans

Guides

Determine If Pet Insurance Is Worth It

Comparison Charts

Find Your State

Dog Insurance

Pawlicy Advisor is the #1 pet insurance marketplace in the U.S. Recommended by veterinarians. Trusted by 1M+ Americans. Our team of veterinary advisors and licensed insurance experts are dedicated to helping pet parents give their dogs and cats the best possible care.