One of the biggest surprises for new pet owners happens when they receive their first large vet bill. Routine checkups are usually affordable, but unexpected veterinary costs are, unfortunately, very standard. Between curious puppies, busy streets, rowdy dog parks, and common genetic predispositions, there’s a lot that could go wrong. In fact, statistics show that every six seconds, a pet owner faces a vet bill of more than $1,0001.

Emergency vet costs are usually more expensive than that, but pet insurance can provide a financial safety net should you ever find yourself in that position. If an accident or illness were to occur, you’d have peace of mind knowing your loved one will get the medical care they need without feeling distraught over your monthly budget.

Dealing with an unwell pet can be stressful enough as it is, and insurance gives you one less thing to worry about. However, it may be challenging to see the value of pet insurance when your four-legged friend is young and without health issues.

If you’re considering pet insurance but aren’t sure it’s the right time to enroll, we’re here to help. This article will guide you through different considerations that can you help you decide whether pet insurance is a great decision for your unique circumstances:

- Top Factors to Consider

- Benefits of Pet Insurance

- How to Decide if Pet Insurance is Right for You

- The Best Time to Get Pet Insurance

- Key Takeaways

Top Factors to Consider

When considering pet insurance, there are a few factors you need to think about:

- Age and type of pet

- Current and longterm health

- Access to care

- Your financial risk

Most pet parents understand how the first several factors impact a pet insurance choice, but the last two points are the most important and the least obvious. Ask yourself the following questions to get a better understanding.

-

Can you provide complete access to veterinary care?

During a routine checkup, a veterinarian will conduct a physical exam. If they find anything wrong, then they might order additional diagnostic tests to confirm their suspicion. These tests are seldom cheap, often leading to a cost-of-care discussion between the vet and the pet owner.

Many uninsured owners are forced to pick and choose the tests and corresponding treatments their pet receives based on cost alone. That means the pet might not receive some diagnostics - such as blood work that can reveal hyperthyroidism in cats or dog x-rays that show an intestinal obstruction - because the test is too expensive. Unfortunately, this results in many conditions going untreated, leaving pets uncomfortable and potentially jeopardizing their life.

With pet health insurance, you can get reimbursed for up to 90% of the diagnostic costs, so your loved one can receive the attention required to improve their health and overall quality of life. If you want your pet to have access to the best care possible, without worrying about affordability, you should seriously consider pet insurance.

-

Is pet insurance a good deal?

One of the biggest concerns owners have is that pet insurance is a “waste of money”. The argument seems straightforward: If you don’t end up using your insurance coverage, you aren’t getting your money’s worth, so pet insurance may not be a good value.

But just like many other types of insurance, pet insurance is designed to protect you against financial risk. You can’t predict whether your pet will get sick, or have a bad accident, and require expensive veterinary care. You may not use all your coverage all the time, but it’s also possible that you’ll need it when the time comes.

With insurance, you know you won’t be liable for thousands of dollars in veterinary expenses. Without it, you may have to dip into your savings or pay off expensive credit card debt because you aren’t getting reimbursed for veterinary costs.

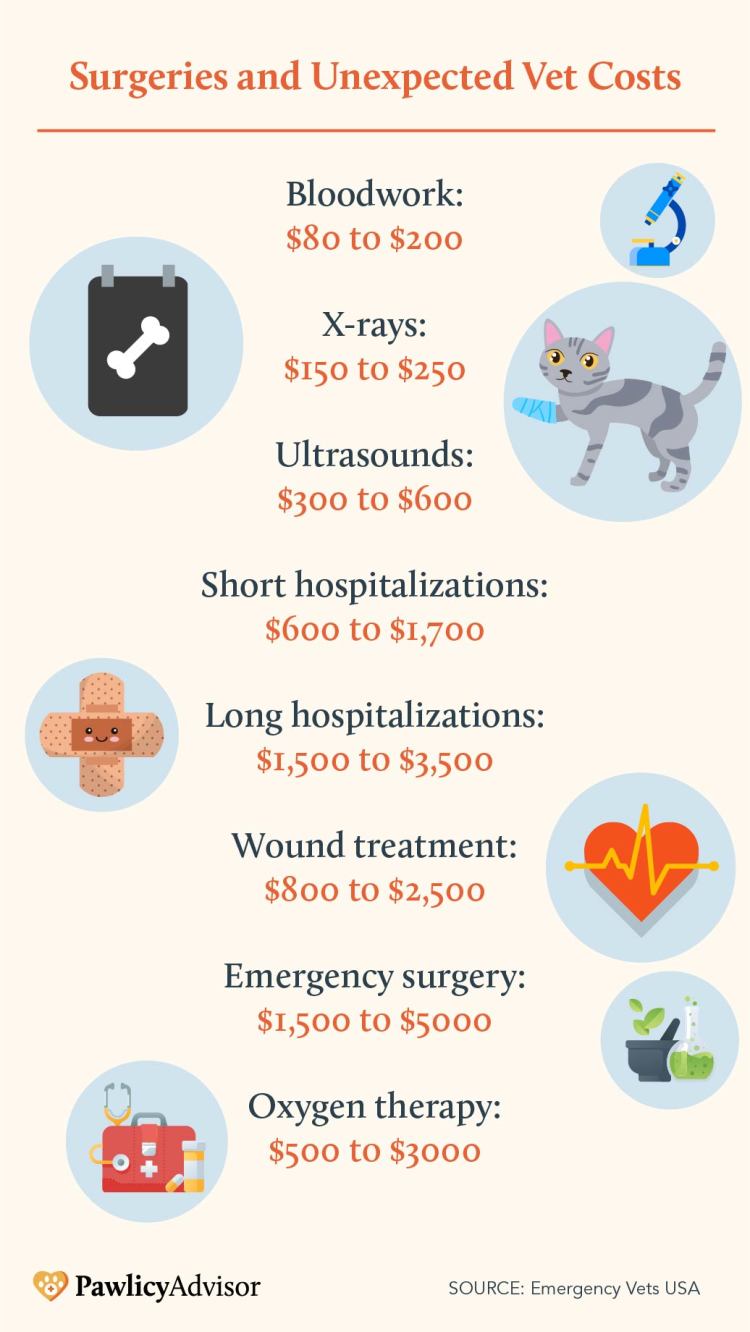

The image above shows what you can expect to pay2 for unexpected veterinary treatments for common emergency ailments, like accidental poisoning and severe injury. Without insurance, you’d have to pay for these costs out of pocket, but with a good plan, you’d only have to pay a fraction of what you see above - depending on your plan, as small as 10%. That would turn a $5,000 bill into $500, which is why most people agree that pet insurance is a good deal.

Pro Tip: If you’re concerned about the monthly cost of pet insurance, many providers offer flexible plans, allowing you to find the one that fits your needs and falls within your budget. Using tools like Pawlicy Advisor, finding affordable pet insurance is fast and easy.

-

How do you envision your future together?

When weighing the value of pet insurance, it’s important to consider the costs you’d save now and over all the years to come. For example, a pet wellness plan can reimburse you dollar-for-dollar for money spent on preventative care, like flea and tick medication, to help keep more money in your pocket in the present. However, insurance also plays a significant role in keeping your pet healthy in their late age. It might sound dramatic, but an insurance plan could even save your pet’s life.

It isn’t a topic owners nor veterinarians like to dwell on, but it’s important to think about how you’ll protect your pet from “economic euthanasia.” This is when a pet owner is faced with the impossible decision of either: A) financing the expensive treatment the animal needs to live comfortably, or B) putting the pet to sleep to prevent them from suffering.

According to recent data3, an estimated 500,000 animals are put to sleep due to economic reasons each year. Veterinarians also estimate incidents of economic euthanasia rise 10 to 12% each year as pets are living longer and longer.

If you enroll in pet insurance while your pet is young, it'll be easier to afford treatment they may need for a severe and unexpected illness, such as lymphoma, so you can maximize their comfort while extending your time together.

Even if your pet is very healthy, and you don’t use your insurance plan for a couple of years, you can still save thousands of dollars in the long run. Imagine the lifetime cost required to care for a chronic condition, or the emergency bill you could face if your loved one were to get hit by a car, for example. The money you spend would be well worth the value - especially if it enabled them to receive a life-saving procedure that prevents them from passing too soon.

Benefits of Pet insurance

We’ve outlined several examples that demonstrate the value of pet insurance, but here are some additional benefits you may not have considered.

-

Peace of mind

You can put a pricetag on peace of mind, perhaps the most important benefits you can glean. Every day, you enjoy coverage protection and know with confidence that your pet will always be in great hands. Should anything ever happen, you’ll be able to focus on spending time with your companion rather than stressing over finances.

-

More treatment options

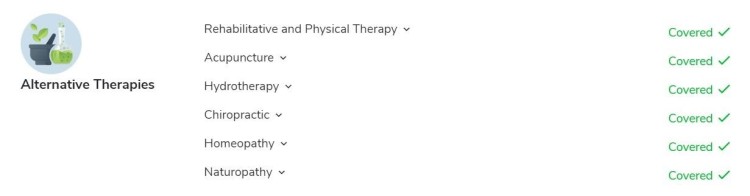

Many pet insurance policies also cover holistic and alternative pet care like physical therapy, chiropractic services, and even acupuncture. If you’re interested in getting coverage for alternative treatment options, scroll down in the “Coverage Details” section until you reach “Alternative Therapies.” There, you’ll see which treatments are covered by the selected plan.

-

Choice of veterinarians

Unlike human health insurance, most pet insurance plans don’t pay the veterinarian directly. Instead, they reimburse you for a percentage of the out pocket costs you pay for veterinary care that’s covered under your plan.

Although you’ll typically need to pay your vet at the time at service before being reimbursed, it also means you can go to any vet you want. There are no “in-network” or “out-of-network” veterinarians. If you have a vet you love, you can continue seeing them after getting an insurance plan.

-

Discounts for multiple pets

To protect as many animals as possible, many pet insurance companies offer incentives for owners to enroll multiple pets. You can save on your monthly premiums by signing up more than one pet insurance policy.

-

Customized policies

You aren’t subject to a one-size-fits-all pet insurance policy. You can use Pawlicy Advisor’s compare pet insurance companies and search for customzied plans based on price, reimbursement rate, and more. If you’d like additional coverage for routine care like dog teeth cleaning costs, you can add on a supplemental wellness plan for as little as $10 per month.

How to Decide if Pet Insurance is Right for You

Most owners and veterinarians agree that pet insurance is a good decision, but that’s not to say that it’s for everyone.

When evaluating pet insurance pros vs cons, some might be disappointed to learn that pre-existing conditions are not covered. However, owners can still receive coverage for unrelated healthcare costs, and had their pet enrolled sooner, the diagnosis could have been covered under their existing plan. Many owners purchase pet insurance for older pets to help cover the cost of end-of-life care and make their loved one as comfortable as possible, but if you have a senior dog with multiple pre-existing conditions, pet insurance may not be for you.

Additionally, those unaware of mandatory waiting periods might think pet insurance is a bad decision if they could not file a claim immediately upon enrollment. Pawlicy Advisor makes it clear to read the fine print prior to enrollment, but be sure to check carefully if enrolling elsewhere. It’s also important to note that pet insurance is not intended for emergency use in response to an unfortunate event.

Pawlicy Advisor is here to help you decide whether pet insurance is a good decision, and if so, show you how to find the best quotes customized to your pet’s unique information. Ask yourself a few more questions to see where you stand:

- Do you have $1,000 to $5,000 on hand for emergency veterinary costs?

- If the answer is yes, would you like to be reimbursed for a portion of your bill?

- Would you like optional coverage for illnesses, like arthritis and diabetes, as well as accident and injury?

- Does your pet’s breed have genetic predispositions that may develop in the future?

- If the answer is yes, have you considered the lifetime cost-of-care you’d pay out of pocket?

- If your dog has a pre-existing condition, would you like financial assistance for all other health concerns?

- Do you want peace of mind knowing your pet has access to the best possible health care?

The Best Time to Get Pet Insurance

The best time to get pet insurance is when your pet is still young. That way, any health conditions that arise after your policy starts will be covered and will not be considered a pre-existing condition. After the waiting period passes, you can even get covered for conditions like hip dysplasia.

Start your search for a pet insurance plan on Pawlicy Advisor and protect your pet today.

Key Takeaways

- Pet insurance is a good decision for most people who want to ensure their pet has access to essential veterinary care at an affordable rate.

- It's important to read the policy's fine print before signing up for a pet insurance plan so that you're aware of all conditions.

- Pawlicy Advisor is the best pet insurance comparison tool owners can use to find and purchase a plan that provides valuable peace of mind.

References

- NBC News. "Biggest Financial Shocks for Pet Owners" Accessed Mar. 18, 2021.

- Emergency Vet USA. "Average Cost of Emergency Visits" Accessed Mar. 18, 2021.

- Spots.com. "Animal Euthanasia Statistics" Accessed Mar. 18, 2021.