What Is Pet Insurance, How Does It Work & What Is Covered?

Reviewed by Kaelee Nelson, Professional Dog Trainer & Animal Behavioralist

Pet insurance protects against unexpected veterinary costs and provides pet owners with invaluable peace of mind. As healthcare costs rise across the board, pet healthcare is no exception and, according to several pet insurance companies, the average amount that most people can afford for veterinary treatment at any given moment is only $1,500. Veterinarians tell our team at Pawlicy Advisor that they have difficult conversations with pet owners about the cost of care anywhere from five to ten times per day.

However, although enrollment rates have steadily increased over the last 5 years, still a large percentage of pet parents are unaware of what pet insurance is and are wondering “How does pet insurance work?”. According to the North American Pet Health Insurance Association (NAPHIA), there are 69 million pet dogs living in the US but less than 2% of them have pet insurance.

This guide will explain what the purpose of pet insurance is and what it covers. In addition, we will discuss the enrollment process, provide explanation on how pet insurance works, and much more.

What Is Pet Insurance?

Pet insurance is a form of insurance that pays, partly or in total, for veterinary treatment of the insured person's ill or injured pet.

In other words, pet insurance is a health insurance policy that covers certain veterinary costs. It gives you peace of mind that, in the event that your dog or cat has an accident, illness, or emergency, it will receive the appropriate care without facing a significant financial burden.

What's the Purpose of Pet Insurance?

Did you know that every year, one in three pets requires unanticipated veterinary care? Being a pet parent means that every day is filled with surprises, and not all of them are pleasant.

If you have pet insurance, you won't have to be concerned about using high-interest credit cards, taking out loans, or worse, deciding to put your pet to sleep because you can't afford the payment.

Here are the main reasons why people get pet insurance:

- Pets have accidents. Accidents like broken bones, torn nails, lacerations, and getting hit by a car can occur at any time. In fact, four out of five pets will experience at least one medical emergency throughout their lifetime.

- Pets get sick. Vomiting and diarrhea are common symptoms that might occur frequently for small reasons or be warning indications of a more serious condition. The cost of treating chronic illnesses in dogs and cats, such as allergies, diabetes, and cancer, can be especially high due to the frequent trips to the vet, diagnostic tests, surgeries, and medications.

- Veterinary bills can be hefty. Americans spent an estimated $32.3 billion¹ on veterinary care and products in 2021, which is an increase by about $2 billion from 2020. With pet health insurance, when an unexpected vet visit occurs, you may easily pay with your credit card, submit a claim, and if it is accepted, you will be reimbursed by the end of the week.

- It’s better than having a savings account. Instead of relying on a savings account, which can take years to accumulate enough money to cover even one major vet bill, purchasing an insurance policy is a great way to make sure you can afford the best veterinary care as soon as your pet needs it.

What Pet Insurance Covers

What pet insurance covers depends on the type of plan you decide to enroll in.

Accident-only plans will only provide reimbursement for emergency care related to accidents , like if your pet is hurt by a car or injures themselves by falling down the stairs. This type of coverage does not cover illnesses or breed-specific issues but only physical injuries such as fractures (broken bones), burns, cuts, etc.

Accident-illness plans provide coverage for both accidents and unexpected illnesses. It is the most common choice, as it represents about 98% of plans issued² by the pet insurance industry. This type of plan won't cover preventive care or pre-existing conditions, but you can expect reimbursement for almost everything else, including treatments for viral infections, parasites, hip dysplasia, and even tooth extraction in the event of dental diseases, in some cases.

NOTE: Many pet insurance companies sell supplemental pet wellness plans , known as policy riders, that cover routine care, preventative care, checkups, and yearly vaccines, but not much else. These are usually sold as add-on features to other health insurance plans. This type of plan does not cover accidents, common injuries, or emergency treatments for illnesses.

The best pet insurance plans can provide substantial coverage for the most expensive health treatment and diagnostics.

However, depending on your insurance plan, your policy may not cover every condition/expense your pet has. This is why it's so important to find a plan that covers your pet's breed-specific health risks .

So, to sum up, pet insurance can cover:

- Unexpected injuries/accidents (like foreign object ingestion, broken bones, and more)

- Unexpected illnesses (like cancer , glaucoma, hip dysplasia , parvovirus, and more)

- Surgery (like cruciate ligament tears , cataracts, and more)

- Medication

- Tests/diagnostics (like X-rays, blood tests, MRIs, and more)

- Emergency exam fees

In general, most pet insurance plans will cover medical expenses in the above categories as long as they are not related to a pre-existing condition. The details will depend on the type of coverage (see the chart below) and the provider you choose.

Some pet health insurance plans also cover:

- Alternative therapies

- Behavioral modification

- Hospital boarding

- Lost pet advertising/reward

- Nursing / Whelping

- Chiropractic care

- Acupuncture

- Hydrotherapy

Types of Coverage [Chart]

Coverage | Accident-Only | Accident-Illness | Accident-Illness + Wellness Add-on |

|---|---|---|---|

Emergency care for accidents | Yes | Yes | Yes |

Treatment & tests for injuries | Yes | Yes | Yes |

Emergency care for illnesses | No | Yes | Yes |

Treatment & tests for illnesses | No | Yes | Yes |

Breed-specific conditions | No | Yes | Yes |

Routine care | No | No | Yes |

Wellness exams | No | No | Yes |

Vaccines | No | No | Yes |

Pre-existing conditions | No | No | No |

🧡 RESOURCES:

- How to Compare Plans, Evaluate Top Providers, and Find The Best Policy

- Are Wellness Plans Worth It?

- Pet Insurance Options For Pre-Existing Conditions

What Does Pet Insurance Not Cover?

The most common exclusion is for pre-existing conditions, i.e. any illness or injury that occurred in your pet's medical past before the coverage began. This also applies if you cancel one policy and buy another.

Other Common Pet Insurance Exclusions:

- Pre-existing conditions

- Routine care/Wellness exams

- Preventative care

- Spay/Neuter

- Vaccination

- Pregnancy and/or birth

- Cosmetic and elective procedures

- Preventable diseases

- Bilateral conditions

- Exclusions

💡 NOTE: Although no pet health insurance providers cover pre-existing conditions, some providers will cover curable health conditions after a certain waiting period with no recurring symptoms. Also, pets with a pre-existing condition are still eligible for insurance, their coverage would only exclude the specific condition that already exists.

Other Types of Insurance Coverage For Pets

There are other types of insurance products that cover other types of pet expenses. Here are a few to keep in mind:

- Pet Health Insurance - covers the cost to treat your pet's illnesses and/or injuries.

- Renter's Insurance For Pets - covers any personal injury or damage your pet might cause to a visitor or guest at your rental property.

- Third-Party Liability Insurance - provides liability coverage for dog owners who neither own a home nor rent, and therefore have no financial protection in the event of a lawsuit.

- Pet Life Insurance - provides reimbursement for the pet’s value in the event it gets stolen or disappears, as well as replacement of future income in the case of show dogs. Insuring your canine’s life will also cover for funeral expenses.

Learn More: What Types of Pet Insurance Do I Need?

How Pet Insurance Works

Wondering “How does pet insurance work?”. We'll break down the general overview of how pet health insurance works in 5 steps:

Step 1: Choose a Plan & Customize Policy

Not all providers are the same. The majority of pet insurance policies typically pay for unexpected illnesses, accidents, surgeries, medications, tests, and diagnostics, as well as the costs of emergency care and exams. However, not all costs in those categories often qualify for reimbursement. The type of pet insurance coverage and the company you select will determine the specifics of your pet insurance policy.

The first thing you need to do is select your type of coverage then customize plan by choosing from the different deductibles, reimbursement limits, and payout limits.

The deductible is the portion of the veterinary bill you're responsible for before your plan's reimbursement kicks in. Most pet insurance companies use an annual deductible. Some insurance companies offer a per-incident deductible, meaning if the same injury occurs more than once in future years, the deductible will no longer apply.

Reimbursement rate is the amount a pet insurance company pays you back for the cost of care. The most comprehensive pet health coverage will reimburse 80% to 100% of your total vet bill (after your deductible is met).

Limits are something you should consider when choosing a plan, especially as you anticipate how much and what type of care your pets might need for their ages and conditions:

- Per-incident limits cap how much you can be reimbursed for a single illness or accident. If exam fees, surgery, lab tests, medications, and follow-up care total $5,000 and your limit is $2,000, you are responsible for over half of the bill.

- Annual limits cap how much you can reimbursed within a 12-month period. Once you hit your plan's annual reimbursement limit, you are responsible for paying until your coverage resets for the year.

Pro tip: Researching breed requirements before choosing a pet insurance can be helpful. Consider the conditions your pet is most likely to experience over the course of their lifetime, and then check to see if they are covered. Keep in mind that each animal is unique, and their age, breed, and lifestyle will influence the health issues they are most prone to.

Step 2: Satisfy Enrollment Requirements

Some pet insurance providers require exams or medical records prior to enrolling your pet in a pet insurance policy.

Depending on the policy, some insurance companies may not cover older animals, while the majority do not cover animals that are younger than eight weeks old.

Finally, since some providers only offer coverage in certain states, your eligibility to enroll may be based on where you live.

Be sure to compare these requirements before choosing a plan.

Learn More: How to Compare Pet Insurance Plans

Step 3: Pay Insurance Premium

On a month-to-month basis, pet insurance works most like renter's insurance. You pay a monthly premium to your insurer for coverage.

Your premium is the fee you must pay each month (or year) to keep your insurance policy active. A higher monthly premium typically means you're paying for more coverage, so you shouldn't always go for the plan that has the lowest premium. Still, a plan with a low premium might be your best option if you're on a tight budget.

Some pet insurance providers also have one-time enrollment fee and/or monthly transaction fees which can be waived if you decide to pay annually.

💡 PRO TIP: If you need to save on monthly costs (your premium), you customize your plan and lower the reimbursement rate, lower the limit, or raise the deductible. Some insurers will increase your premium as your pet ages or after you have filed a claim. Pawlicy Advisor provides a Lifetime Pricing Score to help predict such costs.

Step 4: Visit the Vet

Most insurers impose waiting periods for each type of claim that the policy covers. Illnesses typically have a longer waiting period (usually two weeks) than accidents (usually several days). The longest waiting periods are usually reserved for specific conditions like orthopedic problems and cruciate ligament issues, requiring six months or more before coverage begins.

Once the mandatory waiting period has passed, you can visit the vet as you normally would. You can benefit from your coverage at any licensed vet clinic or animal hospital in the U.S, and some providers will even cover your pet when traveling outside the country.

You will need to pay for the visit upfront at the time of service (this counts toward your deductible) and get reimbursed later after you submit a claim.

Step 5: File a Claim & Get Reimbursed

If your pet requires treatment for a covered illness, accident, or procedure, you will pay the veterinarian directly and file a claim with your pet insurance provider. Be sure to file your claim within the designated window (usually 60 to 270 days after the treatment).

Pet insurance companies offer different options/methods to file claims, including email, mail, fax, online portals, mobile apps.

Insurance companies may need paperwork or a medical history review from your veterinarian to process your claim, so be sure to save all receipts and documentation you receive from your vet appointment.

Policyholders are usually reimbursed via check or direct bank deposit but some providers will offer to pay the veterinarian directly.

If your claim is approved, you will get reimbursed at the rate set in policy (up until to the annual/lifetime limit) after deductible is met. On average, policyholders get reimbursed within 5 to 9 days after submitting a claim.

Pet insurance payout offsets cost of vet bills and can be used in conjunction with veterinary financing options.

Do You Have to Pay Upfront If You Have Pet Insurance?

In most cases, yes, you will need to pay your vet upfront for the treatment, unless your provider offers vet direct pay. This counts toward your deductible but once the deductible is met, you are still responsible for the insurance copayment (typically 10-30% of total vet bill, depending on your chosen reimbursement rate).

Pet insurance vs human health insurance

Due to the fact that pets are legally considered property, pet health insurance is more similar to renters insurance or car insurance, rather than human health insurance. In practice, this means that you can enroll or change your coverage at any time, and your coverage will work at any vet. In contrast, human insurance plans involve a network of hospitals and doctors, typically known as a Preferred Provider Organization (PPO) or Health Management Organization (HMO).

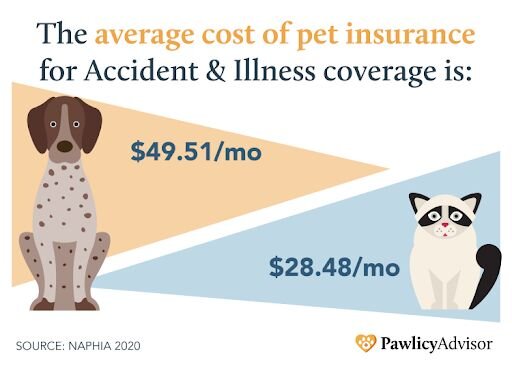

Pet insurance also has much cheaper premiums. Most health insurance plans for humans cost $300+ per month but with pet insurance, these premiums average about $28 a month for cats and $48 a month for dogs.

Another distinction is that pet insurance uses a "fee-for-service" basis, whereas human health insurance plans use a "managed care" model. Essentially, this means that your practitioner will receive direct payment from human health insurance companies (once you cover your deductible). On the other hand, pet insurance companies will reimburse you for claimed expenses on covered medical costs if your deductible is met but you must first pay the whole veterinary bill in order to be able to submit a claim.

Finally, an insurance provider for pets can refuse to cover a pet's pre-existing condition. As of 2014, due to changes in healthcare law, human health insurance providers in the US are no longer able to refuse coverage of pre-existing diseases.

Learn More: What's The Difference Between Pet Insurance & Health Insurance?

How Much Does Pet Insurance Cost?

Pet insurance is generally affordable. The average monthly premium in 2021 was $28.57 for a cat and $48.66 for a dog³, but it's important to recognize that there's a wide range in pet insurance pricing (many see rates as low as $12/mo, others might see rates as high as $100/mo) depending on a few key factors.

Factors That Increase the Cost of Pet Insurance

- Size (height, weight)

- Breed

- Age (compared to its typical life expectancy)

- Location

- Common indoor and outdoor risks in area

- Term and length of insurance policy

- Reimbursement Rate

- Deductible

- Payout Limit

- Plan type

- Policy provider

You can save on pet insurance by enrolling when your pets are still young, as your monthly premiums are guaranteed to be lower. Some pet insurance providers will also give you a discount on your bill if you agree to make annual payments instead of monthly payments. Others offer discounts if you insure multiple pets under the same provider.

Another way to keep your premiums low is to select a higher deductible, but keep in mind that you’ll have to reach that deductible by paying out-of-pocket before your insurance plan begins to reimburse your veterinary costs.

Similarly, you can keep costs down if select a lower reimbursement rate or a lower coverage limit, but this will limit the amount you receive from your insurer if your pet gets seriously ill or injured.

Learn More: The Average Cost of Pet Insurance in 2022

Where to Buy Pet Insurance

There are three ways to enroll in pet insurance:

Through the provider companies.

- Through employer benefits.

- Through the #1 pet insurance marketplace recommended by veterinarians.

💡 NOTE: Wellness plans can be acquired as add-ons should you purchase accident-illness coverage through a top provider on Pawlicy Advisor's marketplace. You can also get a Wellness Plan as a separate enrollment through a dedicated wellness provider or your local veterinary clinic.

Detailed Insurance Provider Reviews:

- ASPCA Pet Insurance Review & Coverage Details

- Pets Best Pet Health Insurance Review & Coverage Details

- FIGO Pet Insurance Review & Coverage Details

- Petplan Pet Insurance Review & Coverage Details

- PetFirst Pet Insurance Review & Coverage Details

- Hartville Pet Insurance Review & Coverage Details

- Lemonade Pet Insurance Review

- Walmart Pet Insurance Review

The Pet Insurance Marketplace Veterinarians Recommend

As pet parents, we know searching for pet insurance is complicated. We know that review sites don't provide enough information. We also know having to submit a quote form with "every" "single" "provider" is a horrible user experience.

Instead, pet parents can use Pawlicy Advisor to see pet insurance quotes from top providers, custom comparison charts, and ranked based on breed-specific health risks and lifetime pricing - all in one place.

The Problem With Simple Review Aggregators

Review aggregators can be a great tool for understanding context on customer service experiences - however, they should not be the deciding factor in your evaluation.

Simple review sites don't provide pet parents with transparency on policy details, breed exclusions, and lifetime costs. Negative reviews don't necessarily mean that the provider or the plan is a poor choice, rather, it's quite possible that the plan was a bad fit for the individual reviewer.

Similarly, good reviews don't offer much information. Every provider has good reviews. The number of reviews is more correlated review collection efforts or brand awareness, rather than how “good” an insurance option is.

The Magic Behind Pawlicy Advisor

Pawlicy Advisor analyzes your pet's health risks, coverage options on the market, and price differences to recommend a policy that will save you substantial money and frustration over your pet's lifetime.

See more 5-star reviews on Facebook and Google.

Fill out one form to run an analysis across hundreds of policy variations from top providers and compare plans in custom comparison charts.

Our goal is to transform the pet insurance industry and enable more people to get their pets the affordable care they need.

🧡 RESOURCES:

Key Takeaways

- Over 2,438,795+ dogs and cats have pet insurance across the U.S.

- Pet insurance helps protect you from unexpected vet bills and gives you peace of mind.

- Whether your pet is susceptible to allergies, developing chronic conditions, or suffering from an accident/injury, plans can put thousands of dollars back into your pocket.

- Anyone who owns a pet should consider pet insurance. While it may be tempting to avoid the monthly costs while your pet is still young and relatively healthy, you can never anticipate what might happen as they grow older. Some conditions can develop rapidly, and accidents happen.

- Most pet insurance programs are for dogs or for cats, as they tend to be the pets that are most expensive to treat. However, there are plans out there that cover birds, reptiles, and other types of pets.

Pet Insurance FAQs

Read through these additional questions to find out more about pet insurance or check out our FAQ page.

Questions & Answers

What is pet insurance and how does pet insurance work?

Pet insurance is health insurance for your pet. It covers (reimburses) the costs of treating unexpected injuries and illnesses, so you don't have to worry as much about expensive vet bills. Unlike human health insurance, you can use your benefits at any vet or animal hospital.

Is it worth it to have pet insurance?

One out of three pets will need emergency treatment, and most Americans can't afford unexpected veterinary bills. Pet insurance is worth it because it helps you afford these costs, so your pet always gets the care they need.

How do you use pet insurance?

After paying a vet bill, you can submit a claim for reimbursement to your insurance provider. Most pet insurance companies let you submit claims online, by phone, or by mail.

How does a pet insurance deductible work?

The deductible is the portion of the bill you're responsible for before you can start being reimbursed for veterinary costs. Most plans come with an annual deductible. For example, if your annual deductible is $1,000, you'll need to pay for $1,000 in veterinary costs each year before you can start getting reimbursed for veterinary costs.

What is the best pet insurance?

Every pet and pet parent has unique needs, but the most popular type of pet insurance is called an accident-illness plan. This type of plan covers the most expensive injuries and illnesses, and it's generally affordable for most pet parents.

When shopping on Pawlicy Advisor, rest assured we only work with the best providers in the industry - and our algorithm will analyze hundreds of options to help you compare the best dog & cat insurance plans based on breed, location, age, lifetime savings, and more.

How much is pet insurance and what does it cover?

The average cost for the most common pet insurance plans (accident-illness plans) is $28.57 for cats and $48.66 for dogs. This coverage reimburses emergency care as well as treatments and tests for unexpected accidents and illnesses like cancer, poisoning, foriegn ojbect injestion, surgery, X-rays, glaucoma, and more.

What factors determine the cost of pet insurance?

The size, breed, age, and geographic location of your pet all influence the cost of your insurance policy. The length of your policy and the company offering your plan also play a role. Finally, you get to determine what type of policy works best for you by selecting a quote that makes sense for your budget.

Can you customize your pet insurance plan after purchasing?

There's no "one-size-fits-all" solution for pet insurance, and many providers allow you to customize your plan to accommodate your personal needs and preferences. While sites like Pawlicy Advisor can help you pick a great pet insurance plan from the start, life happens and things can change, so you might want to change your plan after purchasing. Depending on your provider, this may be possible; however, you may be required to wait until your policy renewal to add or drop coverage to your plan for the following period.

How long does pet insurance take to kick in?

After you purchase insurance, there will be a waiting period in which some coverage is restricted. Waiting periods are determined by the pet insurance company, so it's important to check before you sign up. Most waiting periods last only 14 days.

How do you know which vets accept pet insurance?

Pet insurance doesn't pay your veterinarian directly. Instead, your provider will reimburse YOU for your veterinary costs after you pay your vet and submit a claim to the insurance company. This way, you don't have to worry about whether your vet takes a certain policy or not — you can use any veterinarian you like!

Can pet insurance cover neutering?

Most pet health insurance policies don't cover neutering, but some pet wellness plans will cover it.

Can pet insurance be transferred to a new owner?

Some pet insurance plans are transferrable to a new owner. Contact your pet insurance provider to learn more about their transfer policies.

Can pet insurance drop you?

Yes. A pet insurance company might cancel your policy if you don't pay your monthly premiums. In addition, some pet insurance policies may drop levels of coverage after your pet reaches a certain age.

Can pet insurance be canceled?

Yes. Most providers allow you to cancel your pet insurance policy at any time

Can pet insurance cover antibiotics?

If your pet insurance plan covers prescription medications, then it should cover antibiotics, unless they are prescribed to treat a pre-existing condition.

How does pet insurance work nationwide?

You can use most pet insurance plans at any veterinarian you choose. However, if you decide to move to a new state, your policy may change based on state laws and other factors.

Where can you get pet insurance?

You can get pet insurance by contacting any pet insurance company directly. The easiest way to get it is to search for a plan on Pawlicy Advisor and sign up online.

Why is pet insurance important?

Many pet parents must make decisions about their pet's care based on cost. However, pet insurance helps by reducing financial risk and ensures your pet can always have access to quality care at an affordable rate.

Why get pet insurance?

Most pet owners get pet insurance for peace of mind. It protects them against the financial risk of expensive veterinary service often required for sick or injured pets.

Will pet insurance cover spaying?

Most pet insurance plans won't cover the cost of spaying, but a pet wellness plan can cover the procedure.

Will pet insurance cover surgery?

Yes. A comprehensive accident-and-illness pet insurance plan should cover most surgeries. However, it will not cover elective surgeries or surgeries to treat a pet's pre-existing conditions.

Will pet insurance cover vaccinations?

Neither accident-and-illness plans nor accident-only plans cover vaccinations, but you can get them covered under a pet wellness plan as an add-on feature.

Will pet insurance cover hip dysplasia?

Many pet insurance plans cover the cost of hip dysplasia, but you may be subject to a waiting period post-enrollment for coverage to begin.

Will pet insurance cover medication?

Yes. Many pet insurance plans cover prescription medications.

Will pet insurance cover hernia surgery?

Yes. Many pet insurance plans cover hernia surgeries, but they won't cover hernia surgery if the hernia is a pre-existing condition.

When can you claim a vet bill?

You can submit a claim for reimbursement after paying your veterinarian for their services. However, some policies may require you to wait a certain number of days after your policy activates before you can submit a claim.

Can pet insurance be backdated?

If your pet passes away, many pet insurance companies will backdate your premiums and refund you. However, no pet insurance plan will cover treatment provided before your policy enrollment date.

What is pet insurance like?

Pet insurance works a lot like car insurance. It's designed to protect you from financial risk by reimbursing you for planned and unplanned vet costs.

Does pet insurance cover heart murmurs?

Pet insurance can cover a heart murmur, but not if it's a pre-existing condition. If your pet develops a heart murmur after your effective policy date, then your insurance should cover it.

References:

PetKeen, “Top 20 Pet Spending Statistics To Know In 2022: Who’s Spending The Most On Their Pets?”, Accessed on October 12, 2022

Today’s Veterinary Business, “Insured pet population grows by 18%”, Accessed on October 12, 2022

NAPHIA, “State of the Industry Report 2022, Section 3: Average Premiums”, Accessed on October 12, 2022

Instead, pet parents can use Pawlicy Advisor to see pet insurance quotes from top providers, custom comparison charts, and ranked based on breed-specific health risks and lifetime pricing - all in one place.

The Problem With Simple Review Aggregators

Review aggregators can be a great tool for understanding context on customer service experiences - however, they should not be the deciding factor in your evaluation.

Simple review sites don’t provide pet parents with transparency on policy details, breed exclusions, and lifetime costs. Negative reviews don’t necessarily mean that the provider or the plan is a poor choice, rather, it’s quite possible that the plan was a bad fit for the individual reviewer.

Similarly, good reviews don’t offer much information. Every provider has good reviews. The number of reviews is more correlated review collection efforts or brand awareness, rather than how “good” an insurance option is.

The Magic Behind Pawlicy Advisor

Pawlicy Advisor analyzes your pet’s health risks, coverage options on the market, and price differences to recommend a policy that will save you substantial money and frustration over your pet’s lifetime.

See more 5-star reviews on Facebook and Google.

Fill out one form to run an analysis across hundreds of policy variations from top providers and compare plans in custom comparison charts.

Our goal is to transform the pet insurance industry and enable more people to get their pets the affordable care they need.

🧡 RESOURCES:

Key Takeaways

- Over 2,438,795+ dogs and cats have pet insurance across the U.S.

- Pet insurance helps protect you from unexpected vet bills and gives you peace of mind.

- Whether your pet is susceptible to allergies, developing chronic conditions, or suffering from an accident/injury, plans can put thousands of dollars back into your pocket.

- Anyone who owns a pet should consider pet insurance. While it may be tempting to avoid the monthly costs while your pet is still young and relatively healthy, you can never anticipate what might happen as they grow older. Some conditions can develop rapidly, and accidents happen.

- Most pet insurance programs are for dogs or for cats, as they tend to be the pets that are most expensive to treat. However, there are plans out there that cover birds, reptiles, and other types of pets.

References

Do you want to find the best pet insurance?

Let's analyze your pet's breed, age, and location to find the right coverage and the best savings. Ready?

Analyze My PetAbout Pawlicy Advisor

The pet insurance marketplace endorsed by veterinarians, at Pawlicy Advisor we make buying the best pet insurance easier. By comparing personalized coverage and pricing differences we can save you a ton of money, up to 83% in some instances!

Instantly Compare Pet Insurance Plans

Guides

Determine If Pet Insurance Is Worth It

Comparison Charts

Find Your State

Dog Insurance

Licensed Insurance Producer - Pawlicy Advisor

Kari Steere is a licensed P&C insurance agent in all 50 states and has focused entirely on pet insurance since 2019. As an animal lover with a rescued Terrier named Barry, when she's not helping pet owners find the perfect plan on Pawlicy Advisor, she runs a ranch in Oregon and rehabilitates any animals that come across her path.