Many pet parents wonder, "Is cat insurance really worth it?" For some, it might feel difficult to justify. When your cat is young and healthy, it can be difficult to justify the cost of premiums.

However, our cats’ health is uncertain.

We never know when the worst can happen to our pets. It’s even estimated that one in three pets in the United States will need emergency treatment each year, which can quickly amount to thousands in vet bills without an insurance policy in place.1

But don't just take our word for it — keep reading to see what 10 pet owners had to say about cat insurance on Twitter. These real examples show how much an insurance plan could save you on your cat's vet bills. They may inspire you to enroll your feline friend in a pet insurance policy before a similar scenario were to happen at home.

1. A Hairy Situation

Many of us have hair ties sitting around, and it can be easy for hair ties to end up on the floor after you’ve been tossing and turning in your sleep or you’ve unknowingly knocked one off your dresser. Unfortunately, hair ties can cause a scary emergency for our cats.

Seattle’s Morning News anchor, Colleen O’Brien, experienced a common emergency that many cat parents face: swallowed hair ties.

Her cat’s veterinarian found 12 hair ties inside her cat, which “clogged up” her cat’s system. It’s suspected that Colleen’s cat ate these hair ties over time, and it eventually caught up with him.

She spent an entire weekend sleepless as her cat went into emergency surgery to remove the hair ties. Her vet bill? $5,000.

This bill isn’t an extraordinary amount either. Many cats who undergo intestinal blockage surgery will have veterinary bills ranging from $800 to over $6,000.2

A cat who has swallowed hair ties will often require x-rays and gastrointestinal surgery if the hair ties get stuck. When a cat has consumed multiple hair ties, the hair ties can even form a hard mass that blocks their system. This is considered an emergency and will need immediate attention. Otherwise, it can be life-threatening. Follow-up veterinary attention is often required to prevent infection after intestinal blockage surgery is performed.

2. Amazing Savings Over Time

Cat insurance saves many pet parents considerable money over time, as one tweeter noted. Fay says that she pays around ten pounds ($13) per month for cat insurance and has so far been reimbursed about 1,200 pounds for her cat, which is almost 1,600 U.S. dollars (USD).

These reimbursements from her cat insurance provider were for multiple treatments, including necessary tooth cleaning and extractions for her cat and treatment for a urinary problem that prevented her cat from peeing. Fay’s experience shows that the cost of high-quality veterinary care can really add up over time. Fortunately, having a pet insurance plan in place can help you save a lot.

3. A Scary Hit and Run Situation

It’s many outdoor cat parents’ worst fear: their cat being hit by a car.

Unfortunately, this is exactly what happened to Dex, who was hit by a car near his home.

Dex managed to drag himself home and was saved by university animal hospital veterinarians. Fortunately, his cat parent had pet insurance because the surgery and days in intensive care cost a staggering 8,000 pounds (about $10,600).

We’re pleased to report that Dex is doing great and is now a full-time indoor cat.

Accidents can happen to our cats at any time, and most emergency veterinary bills will cost between $800 and $1,500.3 However, some treatments, such as Dex’s surgery, will cost far more depending on the severity of the accident and needed treatments.

4. Insuring Multiple Cats Paid Off

Many Americans have more than one cat, which makes having pet insurance even more critical to help cover the costs should one or more of your cats get sick or have an accident.

Sheila noted that she has pet insurance for both of her cats and says she feels lucky because it saved her a lot of money. One of her cats needed cleft palate surgery which her pet insurance reimbursed her for. This is significant because cleft palate surgery often costs around $1,000, with some surgeries costing as much as $3,000.4

Her other cat needed treatment for kidney issues, which can cost thousands of dollars to manage. Chronic or acute kidney treatments can easily cost $3,000 for kidney stone removal, and dialysis can start at $2,500 to $3,000, then cost $500 for ongoing treatments if needed.

Sheila reported that her pet insurance provider reimbursed her promptly and ultimately saved her a ton of money for these necessary veterinary treatments for her cats.

5. Life Saving Cat Insurance

One tweeter reported that her cat, Chip, nearly died if it wasn’t for his pet insurance plan.

Initially, Chip’s veterinarian didn’t think her cat would live after his car accident. At best, Chip’s parent thought her cat’s leg would need to be removed, which typically costs around $550 for felines.5 However, an orthopedic veterinary specialist was able to examine her cat’s leg and treat it. With help from inserted pins and plates, Chip didn’t lose any of his legs and can now walk.

The best part? Cat insurance reimbursed Chip’s pet parent, and now they are back to enjoying their life together.

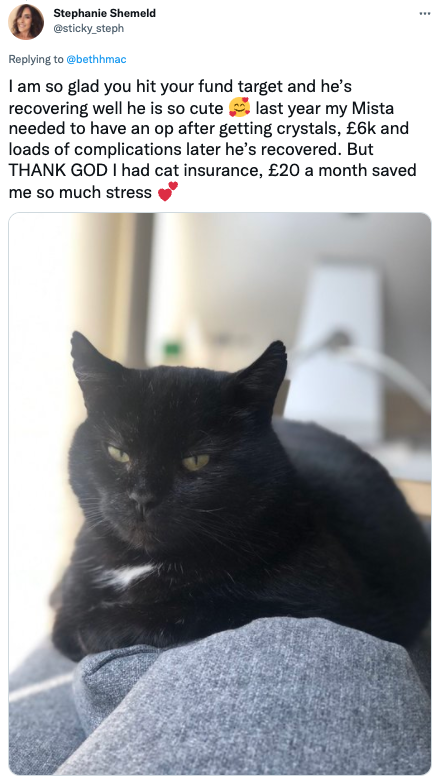

6. A $7,900 Cat Surgery

Stephanie shares that her cat, Mista, needed a 6,000 pound (approximately $7,900) surgery after developing crystals and having complications along the way. Feline urethral obstructions are pretty common as they account for around 10% of feline cases in small animal emergency clinics6. Unfortunately, this condition is incredibly painful for cats and expensive to perform.

The average cost of a single non-surgical case of feline urethral obstructions will typically cost between $750 and $1,500. Recurring obstructions that require surgery will usually cost over $3,000 and continue to get more expensive for cats that re-obstruct or experience complications, like Stephanie’s cat Mista7.

Fortunately for Stephanie, Mista’s treatments were covered by her cat insurance. She reports that she only pays around 20 pounds ($26) monthly and is incredibly happy with how much financial and emotional stress her cat insurance plan saved her.

7. The $15,000 Cat

Constance has definitely gotten her money’s worth from her cat insurance plan. Throughout her cat’s lifetime, her cat insurance plan has reimbursed her for two life-saving veterinary treatments and is now paying for his “extremely aggressive” cancer treatments.

Cancer is an all too common disease among felines. Depending on the type and severity of the cancer, your cat may need surgery, radiation, chemotherapy, or more. These treatments are on top of diagnostic testing, which is necessary to gather more information about your cat’s health. Cat cancer costs average around $3,282 without help from pet insurance.8

More aggressive types of cancer, like Constance’s cat is experiencing, can require many rounds of chemotherapy or radiation and even multiple surgeries, which will add to that average cost. We’re glad that Constance had a safety net in place with her pet insurance plan.

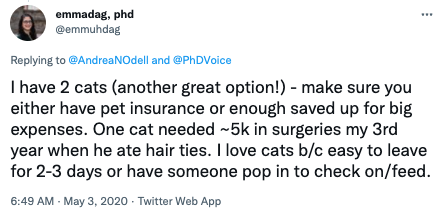

8. More Hair Ties

Cats love playing with hair ties and seeing them bounce across the room. Unfortunately, cats will also swallow hair ties, leading us to another example of pet insurance helping a pet parent out when their cat ingested hair ties.

Emma is a graduate student with two amazing cats. In her third year of school, one of her cats needed $5,000 in surgeries after eating multiple hair ties. Fortunately for her, she had pet insurance which helped with the costs.

9. A Suspicious Limp

One tweeter shared an interesting story about her cat. She took her cat to the veterinarian after noticing her cat was limping. Then the very next day, her cat stopped limping altogether and was fine. The x-ray bill came to 850 pounds (around $1,130). However, she was reimbursed by her pet insurance provider for 630 pounds, or $837.

She notes that she is a bit suspicious of her cat now. Better safe than sorry, though! Fortunately for her, her pet insurance reimbursed her for the majority of her cat’s x-ray costs, which ultimately gave her peace of mind that her cat was okay.

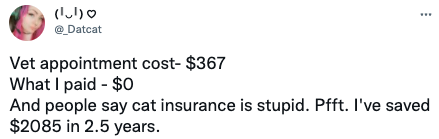

10. Saving Over $2K in 2.5 Years

We often underestimate the cost of routine care, such as regular vet appointments and vaccines. However, these costs can quickly add up. Many routine veterinarian appointments cost between $50 to $250, with physical exams costing another $45 to $55.

We’re not surprised to read that _datcat has saved $2,085 by having a cat insurance plan in place. Her cat’s recent vet appointment would have cost $367 out of pocket, and she walked out of there owing nothing thanks to her pet insurance plan.

Routine vet appointments allow your veterinarian to catch health problems early on, improve your cat’s prognosis, and give you personalized advice for how to best care for your cat. It’s crucial that cat parents are aware that routine care can add up quickly, which is why a wellness plan added to your cat insurance plan is beneficial.

Final Thoughts

We hope these tweets helped by showing you real-life examples of why cat insurance is a good decision and how it can save you a lot of money with different kinds of veterinary care.

Interested in comparing top cat insurance providers and viewing personalized plan recommendations side-by-side? Click the link below to get started.

References

- CNBC, “Most Americans own a pet, but the insurance 1 in 3 faithful companions will need,” Accessed Nov. 29, 2021.

- Berkeley Dog & Cat Hospital, “Cat Intestinal Blockage,” Accessed Nov. 29, 2021.

- CNBC, “Are you prepared for a pet emergency? Most Americans are not,” Accessed Nov. 29, 2021.

- Wag Walking, “Cleft Palate in Cats,” Accessed Nov. 29, 2021.

- Helping Hands Vet, “Procedures Pricing,” Accessed Nov. 29, 2021.

- Today’s Veterinary Nurse, “Urethral Obstruction in Male Cats,” Accessed Nov. 29, 2021.

- Preventive Vet, “Help My Cat Can’t Pee Feline Urethral Obstruction,” Accessed Nov. 29, 2021.

- CareCredit, “Cat and Dog Chemotherapy Costs,” Accessed Nov. 29, 2021.