Best Multi-Pet Insurance 2025 | Multi-Pet Discounts And Strategies

Reviewed by Kari Steere, Licensed Insurance Producer

Updated: Jun 25, 2025

Caring for multiple pets can get expensive, but pet insurance can help by limiting your exposure to vet bills. Pet owners with more than one dog or cat can also save money by enrolling their pets under the same insurance provider.

Multi-pet coverage varies from one insurance company to the next, but some providers can offer you a discount as high as 10% for insuring multiple pets under their brand.

Compare Top Pet Insurance Companies Side-by-Side

Use Pawlicy Advisor to get personalized quotes from leading brands and see how each plan stacks up — instantly.

100% free to use. No fees. No commitment.

Let's explore everything you need to know about getting pet insurance for multiple pets and how you can find the perfect plans for your furry family members:

- Best Multi-Pet Insurance Companies

- How Does Multi-Pet Insurance Work?

- What Does A Multi-Pet Insurance Policy Cover?

- The importance of having pet insurance for multiple pets

- What are the benefits of multi-pet insurance?

- Discounts available for multi-pet insurance policies

- How to find the right multi-pet insurance for your pets

- Strategies for Maximizing Savings with Multi-Pet Insurance

- How to enroll more than one pet on your insurance policy

Best Multi-Pet Insurance Companies

Company | Multi-Pet Discount | Maximum Coverage Options | Special Notes |

|---|---|---|---|

Embrace | 10% | $2,000 - Unlimited | Discount applies to additional pets |

ASPCA | 10% | $2,500 - Unlimited | Applies to each pet after most expensive one |

Pumpkin | 10% | $5,000-Unlimited | Applies to additional pets after first |

Spot | 10% | $2,500-Unlimited | Doesn't apply to first pet's premium |

Prudent Pet | 10% | $10,000 - Unlimited | Consistent discount for multiple pets. |

MetLife | 10% | $500 - Unlimited | 5% for second pet and 10% for any additional pet after |

Nationwide | 5-10% | $2,500 - $10,000 | 5% for 2-3 pets, 10% for 4+ pets |

Petco | 5-10% | $2,500 - $10,000 | 5% for 2-3 pets, 10% for 4+ pets |

Figo | 5% | $5,000-Unlimited | Discount applies to all eligible pets; doesn't increase beyond 5% for more pets. |

Pets Best | 5% | $5,000-Unlimited | Discount applies to all eligible pets; best to enroll all at once for discount. |

Lemonade | 5% | $5,000-$100,000 | Discount applies to both pets' policies. |

AKC | 5% | $5,000 - Unlimited | Discount applies to additional pets. |

Odie | 5% | $10,000 or $40,000 |

How Does Multi-Pet Insurance Work?

If you have more than one furry friend, you would benefit from having multi-pet insurance to make it easier and more affordable. Most insurance companies offer individual pet coverage for each pet, while some offer a shared policy to group pets together.

Coverage Options

Having separate policies means coverage levels, deductibles, and reimbursement amounts can be customized for each pet based on their needs. Some providers, such as MetLife, offer a Family Plan that covers up to three pets under a single policy. Instead of juggling multiple deductibles, you share one deductible and one annual limit across all pets. It’s simple and can be a great money-saver for households with multiple pets.

Discounts and Savings

Most insurers reward pet parents who cover more than one pet. You can often get multi-pet discounts of 5% or higher, depending on the provider.

- Embrace, ASPCA, and Pumpkin typically offer 10% discounts, although the application of these discounts may vary.

That means you could save a chunk of change just by bundling your pets under one provider.

Claims Process

Even with multiple pets, the claims process stays the same. You’ll typically pay the vet directly, then submit your receipt for reimbursement. Some providers offer direct vet pay, which means they’ll handle the bill for you, but this feature isn’t standard, so double-check before you choose.

Management

Are you worried about juggling all those policies? Don’t be, because most companies let you manage everything through a single online dashboard or mobile app. You can file claims, check coverage, and track your pets’ health, all in one place.

What Does A Multi-Pet Insurance Policy Cover?

A multi-pet insurance policy lets you cover all your pets with one insurer to save you time, and often money. Here’s some of the new and unexpected conditions that are typically covered:

Core Coverage

- Accidents: Broken bones, bite wounds, swallowed objects

- Illnesses: Infections, cancer, diabetes

- Emergency care

- Diagnostics: Lab tests, MRIs, CT scans, ultrasounds, X-rays

- Surgery and hospitalization

- Prescription medications

Additional Coverage (varies by provider)

- Third-party liability: In case your pet damages property or injures someone.

- Lost pet expenses: Reimbursement for advertising, posters, or pet-finding services.

- Holiday cancellation costs: Coverage if a pet emergency forces you to cancel travel plans.

Routine stuff like dental cleanings, vaccines, and annual checkups usually aren’t included in core coverage. However, you can often add a wellness plan to help cover those costs. Besides convenience, a multi-pet policy often unlocks discounts depending on the provider. You also get the peace of mind of managing all your pets’ coverage from one simple dashboard.

The Importance of Having Pet Insurance For Multiple Pets

Many pet parents struggle with the decision to buy pet insurance because they don’t like the idea of adding extra costs to their monthly budgets. Sure, there are pros and cons to purchasing pet insurance, but you’ll protect your pet and your wallet if you have to bring one of your pets to the vet for emergency care or an unexpected cost at a regular visit.

Millions of households own more than one dog or cat, and the costs of caring for multiple pets can add up. The estimated lifetime cost of caring for just one dog amounts to $40,000 or more 1, and a large portion of those costs are from veterinary expenses. For instance, an emergency vet bill can easily cost over $3,000, depending on the treatment your pet needs. Having more than one pet significantly increases your risk of financial burden.

Emergency vet visits can easily amount to $3,000 or more

If you’re one of many with a few four-legged family members at home, then pet insurance is important to protect you from unexpected and sometimes unaffordable costs at the vet. This ensures your pets always get the care they need when they need it, and that cost is less of a barrier to care.

Recommended Reading: Can You Have More Than One Dog Insurance Policy?

What are the benefits of multi-pet insurance?

Of course, vet bills aren’t the only concern. Here are several other ways you can benefit from multi-pet insurance.

Treat Your Pets to Regular Care

Most experts agree that pets should visit the veterinarian at least once per year, but preferably more often than that. Younger pets, especially puppies and kittens, may need to visit the vet every month.

Pet parents who have pet insurance go to the vet more often. Which is great! According to one study, pet owners with insurance had visited the vet almost twice as often as those without insurance.2

The reasoning behind this is simple. If you have insurance, you can go to the vet in confidence without worrying about what an unexpected cost might do to your budget.

This means your pets get to receive a physical exam and an overall health assessment more regularly. They’ll also get routine treatments more often, such as teeth cleanings, parasite control procedures, vaccinations, and even grooming.

If you have an insurance policy with a wellness coverage add on, many of these expenses may even be covered by your plan. This can significantly reduce the costs of wellness care for multiple pets (especially new puppies or kittens).

Identify Symptoms Early

Another benefit of bringing your pet in for regular veterinary visits is the opportunity to spot illnesses or injuries early. As with human diseases, it’s much easier to treat a pet’s condition if it’s diagnosed before it goes untreated and gets worse.

This is especially true of serious conditions like cancer, for example, as well as for chronic conditions like diabetes or hip dysplasia. It’s also important to recognize hereditary conditions as soon as possible, to prevent irrevocable damage from occurring.

With insurance, you won’t have to worry about the cost of diagnostics or treatment if your insurance policy covers them. Your veterinarian will be able to run all the tests they need to confirm your pet’s illness. And if a second pet gets sick, they'll be able to receive the same gold-standard care.

Know Your Coverage During an Emergency

Pet insurance is vital when you have multiple pets because a single emergency could cost thousands of dollars out of pocket, and god-forbid you have more than one emergency.

While it is less likely that all your pets will have an emergency at the same time, it isn’t unheard of. Accidental poisonings can impact an entire household, and environmental risks can affect every pet under one roof.

1 in 3 pets will require emergency treatment every year

But even if you don’t have multiple emergencies at the same time, note that one in three pets will require emergency care every year. Even if you have the means to put money aside each month for potential ER visits, pet insurance could prevent you from paying thousands of dollars out-of-pocket when one or more of your pets get seriously ill or injured.

Discounts Available for Multi-Pet Insurance Policies

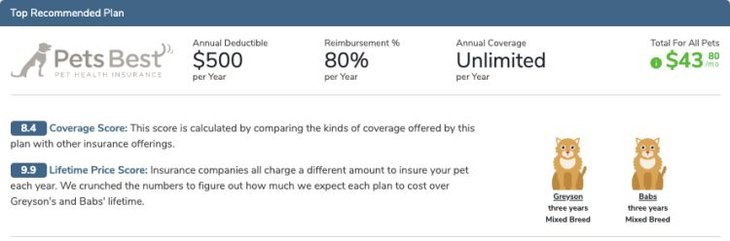

If you have multiple pets, many providers offer multi-pet insurance discounts that reduce your premium rate for each additional pet you enroll. The table below shows how much you can expect to save at each company.

As you can see, some (but not all) providers offer savings incentives for getting pet insurance for multiple pets, and the discounted rate you could receive will vary by company. Some offer discounts as high as 10% off, while other companies like Trupanion don't offer multi-pet discounts at all.

Keep in mind, the best pet insurance for multiple pets isn't necessarily the cheapest plan with the most savings; you'll need to consider other factors such as the annual payout limit, reimbursement rate, and deductible amount to find the best solution for your personal preferences.

Pawlicy Advisor makes it easy to find great deals on pet insurance.

Discover hidden savings and quickly compare quotes from top providers at the lowest possible rate — guaranteed.

100% free to use. No fees. No commitment.

The Typical Costs of Pet Insurance

Naturally, not every pet will have the same monthly premiums for their insurance. The costs of pet insurance are calculated based on your pet’s species, age, size, and breed. Where you live is also a determining factor in what you pay each month.

Monthly premiums for a pet insurance policy can cost as little as $10, but you may not be getting very much coverage at that price. Similarly, you could spend as much as $100 or more per month on a single policy, but you may not want to pay for that much coverage if it puts too much of a strain on your budget.

Older pets cost more to insure, but they are also the most likely to need veterinary care. If you have a mix of older and younger pets at home (including any rescue pets), it may be a good idea to take advantage of a multiple pet discount so you can save on your older pets’ insurance costs.

How to Find the Right Multi-Pet Insurance for Your Pets

Finding the best multi-pet insurance isn’t just about picking the cheapest option; it’s about choosing a plan that fits your pets, your budget, and your peace of mind. Here’s how to do it:

- Compare multiple providers - Start by getting quotes from multiple companies. At Pawlicy Advisor, you can compare multiple pet insurance companies all in one place. Look beyond the price and consider each provider’s coverage, customer reviews, lifetime value, and how easy it is to file a claim.

- Assess your pets' specific needs - Look for plans that let you adjust coverage per pet, or consider a shared policy if that works for your situation.

- Review policy terms carefully - Don’t skip the fine print. Pay close attention to:

- Coverage limits and reimbursement percentages

- Deductible options (per pet or shared?)

- Waiting periods before coverage kicks in

- Exclusions, especially for pre-existing conditions

If you have any known medical issues, make sure the plan doesn’t leave you hanging.

- Evaluate multi-pet discount options - Most providers offer 5% to 10% off when you insure more than one pet. But remember that a higher discount doesn’t always mean a better deal. Be sure to compare total costs, including deductibles and co-pays.

- Consider policy flexibility - Do you want one simple policy that covers everyone? Or separate plans tailored to each pet? Some insurers, such as MetLife, offer a Family Plan that covers up to three pets under a single policy with a shared deductible, which is beneficial for convenience and savings.

- Align with your budget - Balance your monthly premium with the level of coverage you actually need. A low monthly rate might look great until you’re stuck with a big vet bill and a high deductible.

What to Look for in an Insurance Policy

Choosing the right pet insurance starts with understanding what you’re paying for and what you’re getting in return. Your monthly premium is the amount you’ll pay each month to keep your pet’s policy active. Lower premiums can save you money upfront, but they may come with higher out-of-pocket costs down the road, so it’s important to weigh what works best for your budget.

You’ll also want to look at the annual deductible, which is the amount you’ll need to pay out of pocket each year before your insurance starts reimbursing you. Plans with lower deductibles usually have higher monthly costs, and vice versa. After you meet your deductible, your insurance kicks in and pays a percentage of your vet bill, this is your reimbursement rate. Most plans offer a refund of between 70% and 90%, depending on your selection when signing up.

Your plan may also have an annual coverage limit, which is the maximum amount your provider will reimburse in a year. Some plans cap this amount, while others offer unlimited coverage for peace of mind. Beyond costs, you should consider what the plan actually covers. Most pet parents choose accident and illness plans, which include things like broken bones, infections, and chronic conditions such as diabetes or cancer. If you're looking for something more budget-friendly, accident-only plans are available and typically come with lower premiums, but they only cover injuries, not illnesses.

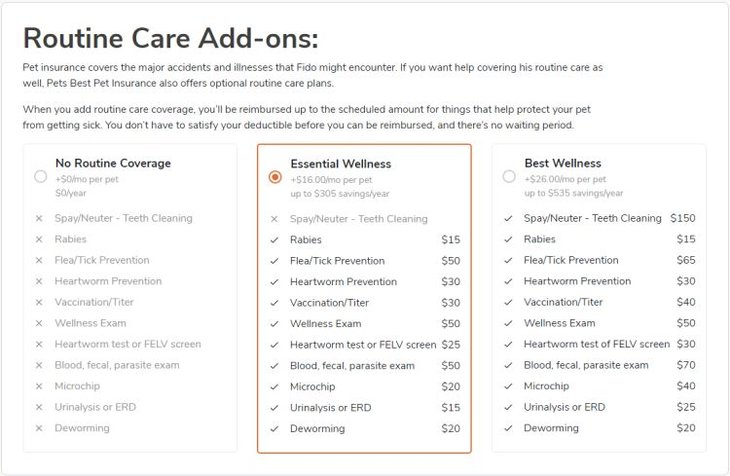

Some plans also allow you to add optional wellness coverage for a slightly higher monthly cost. This can help cover the cost of routine care, including vaccinations, flea and tick prevention, annual checkups, and dental cleanings. It’s a good option if you want to offset the cost of basic vet visits. Just keep in mind that no pet insurance policy covers pre-existing conditions. However, some providers do make exceptions for curable conditions after a waiting period. If your pet has recurring health issues, look into providers that offer alternative savings programs or limited-coverage options.

Ultimately, the best insurance plan is one that fits your pet’s health needs and your financial comfort. Look for a balance between affordability and coverage, and make sure you know exactly what’s included before you enroll.

(Simplified Routine-Care Add-ons via Pawlicy Advisor)

Adding routine care to your pet insurance plan can be a smart move, especially if you’re insuring more than one pet. With the Essential Wellness add-on from Pets Best, a pet parent could save up to $305 per year on routine vet visits for just one pet. Multiply that by three or more pets, and the savings can quickly climb past $1,000 a year. It’s an easy way to offset the costs of regular care, such as vaccinations, flea prevention, and dental cleanings.

Comparing Pet Insurance Policies

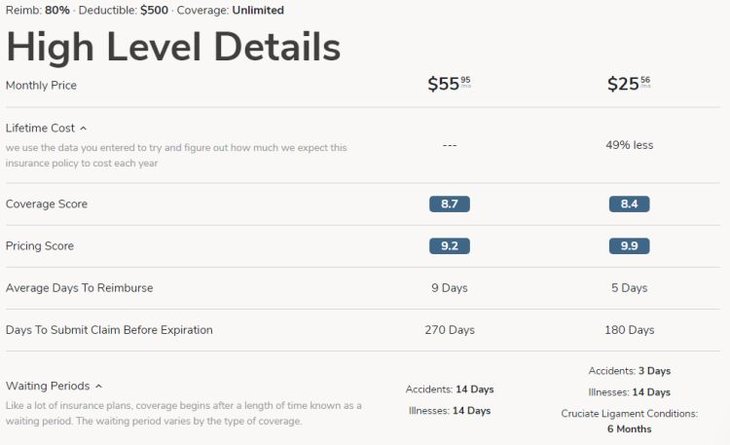

Comparing pet insurance used to be a tedious process. You had to visit multiple websites, request quotes, take notes, and try to make sense of it all. Now, tools like Pawlicy Advisor do the heavy lifting for you.

Just click "compare," and you’ll instantly see a personalized chart that lays out your options side by side, which makes it easier than ever to choose the right plan for your pet and your budget

Pawlicy Advisor is a free tool and gives you everything you need to make a smart decision. We show you the evaluated lifetime value of each plan, how much coverage it offers, and how the pricing compares across providers. You can even see how long each company typically takes to reimburse you after you’ve paid your vet bill, which is super helpful when you're budgeting.

Pretty cool, right?

You’ll also see detailed information about what each plan covers and doesn’t cover. This allows you to compare plans based on your pets’ unique needs.

The best way to find the perfect plan for your pet is to create a detailed comparison chart and see options from multiple top providers side-by-side. You're looking for one that has the right lifetime cost projections, the right coverage for your specific breed(s), and ideally a "multiple pet discount."

Looking to save on vet bills? See which pet insurance is right for you.

Instant results. 1M+ pet parents served.

⭐⭐⭐⭐⭐ 4.9 stars across hundreds of reviews.

See which pet insurance is right for your best friend.

Strategies for Maximizing Savings with Multi-Pet Insurance

- Compare quotes across providers - Discounts range from 5% to 10%, and coverage options can vary widely between companies.

- Look for family plans - Insurers like MetLife offer shared deductibles for multiple pets, which can be more affordable than individual plans.

- Choose appropriate coverage levels - Avoid overpaying for coverage by choosing different plans based on each pet’s age, breed, and health needs.

- Optimize deductibles - A higher deductible lowers your monthly premium, but make sure you can afford the out-of-pocket costs if something happens.

- Consider direct vet payment options - This feature allows the insurance company to pay your vet directly, simplifying the claims process and reducing reimbursement wait times.

- Evaluate wellness plan value - While they add to your monthly cost, these plans cover routine care like vaccines and may save money long-term.

- Check for valuable add-ons - Extras like physical therapy or alternative treatment coverage can be worth it for pets with specific medical needs.

How to Enroll More Than One Pet on Your Insurance Policy

First, find an insurance brand that fits and one that will cover the unique needs of each one of your pets. Keep in mind that each insurance policy is unique, so coverage offered by one policy may not translate to another if the breeds are different, even if it’s offered by the same brand.

Some pet parents shop for individual plans for each of their pets through Pawlicy Advisor before running a search analysis for multiple pets simultaneously. You may want to do this if one or more of your pets have unique needs that aren’t addressed by one brand of pet insurance, but you prefer that brand for your other pets. Keep in mind that multiple pet discounts won’t apply if you enroll your pets under plans from different pet insurance brands.

Regardless, Pawlicy Advisor makes it easy to enroll multiple pets. If you have multiple pets to insure, simply generate a new search and the free tool will analyze policies across top insurance companies to find the best fit for you (including a multiple pet discount) - based on your pets' breed, age, location, and more.

By comparing top insurance companies and your pet’s breed-specific health risks, you can save up to 75% on the lifetime costs of your insurance plan, on top of the multi-pet discount applied for additional animals. That's huge when we're talking "pet lifespan" scales. It’s an ideal tool for insuring multiple pets with unique health needs and taking advantage of savings in the process.

Pawlicy Advisor is the #1 pet insurance marketplace in the U.S. Recommended by veterinarians. Trusted by 1M+ Americans. Our team of veterinary advisors and licensed insurance experts are dedicated to helping pet parents give their dogs and cats the best possible care.

Do you want to find the best pet insurance?

Let's analyze your pet's breed, age, and location to find the right coverage and the best savings. Ready?

Analyze My PetAbout Pawlicy Advisor

Recommended by the American Animal Hospital Association and veterinarians nationwide, Pawlicy Advisor makes buying the best pet insurance easier. We compare top brands and match you to the right protection at a great price. Our free service has helped over 1 million happy pet owners.

More on Insurance Provider Reviews

More on Pet Insurance

Guides

When Pet Insurance Is Worth It