Is Cat Insurance Worth It? Ask An Expert

Reviewed by Kari Steere, Licensed Insurance Producer

Updated: Oct 01, 2025

Is cat insurance worth it? In many cases, yes — but it really comes down to your cat's needs, your budget, and how much risk you're willing to take on.

When my fiancé and I rescued and fostered cats in Brooklyn, NY, we quickly learned just how expensive vet bills can get. My own cat, Greyson, had a $1,200 dental extraction due to feline stomatitis, and we were incredibly grateful that we had pet insurance to get reimbursed for most of that cost.

Compare Top Pet Insurance Companies Side-by-Side

Use Pawlicy Advisor to get personalized quotes from leading brands and see how each plan stacks up — instantly.

100% free to use. No fees. No commitment.

Key Takeaways

- Cat insurance can be worth the cost because it helps offset the financial burden of unexpected (but all too common) cat health issues.

- Pet insurance plans are customizable, giving you the freedom and flexibility to find a coverage solution that fits your budget.

- It's easy to compare cat insurance quotes and coverage options on Pawlicy Advisor, and the sooner you enroll, the sooner you can start getting reimbursed.

In this guide, we’ll break down what’s covered, share real-life vet bill examples, and provide a straightforward checklist to help you decide if pet insurance makes sense for you.

The average cost of annual vet care for cats

Caring for a cat costs approximately $1,070 a year. You’ll shell out money for nutritious food, toys, climbing trees, kitty litter, a litter box, and training in the first year - but that doesn't include the cost of vet visits.

Real Examples: What Emergency Vet Bills Actually Cost

Unplanned vet visits can quickly become a financial burden for pet owners, especially when cats face unexpected illnesses or emergencies. Without basic pet insurance, the cost of treatment for the most common illnesses in cats can skyrocket.

Here are a few examples of typical veterinary expenses:

- Feline Urinary Tract Infections (UTIs) – $6,000UTIs are the most common health issue in cats, especially older females. Lab tests, antibiotics, and even surgeries can cost up to $6,000. If not treated properly, they can easily recur.

- Diabetes – $300/month (up to $1,000+ if hospitalized)Diabetes is a costly condition for both cats and humans. Cat owners might spend $300 a month on insulin, and $1000+ if their cat is hospitalized for ketoacidosis.

- Kidney Disease – $5,500-$6,000 (+$500 per treatment)Kidney disease is especially expensive and complicated to treat. Depending on the type (chronic or acute/sudden onset), kidney treatments can cost $3,000 for kidney-stone removal surgery, $2,500 - $3,000 for the first week of dialysis, then $500 per treatment afterward if needed.

Cats are also susceptible to communicable diseases such as ringworm and chronic conditions like hyperthyroidism that require ongoing hormone therapy to treat.

According to data published by PetFinder, cat owners can expect to pay anywhere from $110 to $550 per year for veterinary care and vaccines, plus up to $200 for flea and tick prevention. This is, of course, assuming your cat doesn’t have a serious condition that requires treatment.

If they develop any of these expensive conditions above, the cat’s vet bills can be as high as $7,000 or more in a single year.

Regular Vet Checkups

Like dogs, most cats should visit a licensed veterinarian at least once a year1 for a wellness check. This gives your veterinarian to check for problems that you may not be aware of just by observing your cat’s behavior at home.

NOTE: If you adopt a kitten or rescue an older cat, you’ll need to bring them to the vet more often.

According to Barry Veterinary Hospital2 in Miramar Beach, Florida, “Exactly how often your kitty will need to attend routine veterinary care exams will depend on her age and how healthy she is. Initially, your vet will probably recommend that your furbaby has a check-up every 12 months and annual wellness appointments tend to be standard for young and adult cats. If your kitten hasn’t received her full set of vaccinations, you may also need to attend appointments for these to be carried out. You will also need to schedule a visit to arrange to get your kitty spayed/neutered.”

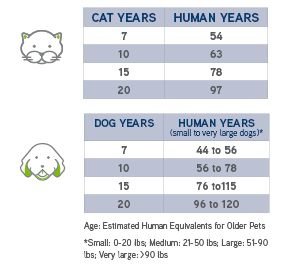

Thanks to dietary improvements, medical advancements, and preventive care, pets are living longer than ever. Keep in mind that cats often live longer than larger breeds of dogs, and the AVMA says a cat that's just seven years old is equivalent to a 54 year-old human2.

(Image source: AVMA3)

As your pets get older, they may need to go to the veterinarian more often. The AVMA states, “Geriatric pets should have semi-annual veterinary visits instead of annual visits so signs of illness or other problems can be detected early and treated. Senior pet exams are similar to those for younger pets, but more in-depth, and may include dental care.”

Cat Insurance Coverage: What’s Included and What’s Not

Cat insurance covers eligible vet services that you pay for out-of-pocket, such as unexpected surgery, diagnostic testing, exam fees, prescription drugs, and more. There are three types of insurance plans for cats, each with different degrees of coverage: accident-only, accident/illness, and wellness plans.

What’s Covered: Accidents, Illnesses, Chronic Conditions

This is the most popular type of pet insurance plan for cats, offering greater protection with coverage for both accidents and cat illnesses. If your cat breaks their leg, you’ll be covered, just as you’d be covered if your cat were to get sick. Illnesses common in cats include 4 :

- Cancer

- Diabetes

- Feline Immunodeficiency Virus (FIV)

- Feline Leukemia Virus (FeLV)

- Heartworm

- Rabies

- Ringworm

- Upper respiratory infections

- Intestinal parasites like tapeworms

If you sign up for cat insurance before your pet develops any of these conditions, an accident/illness plan with comprehensive coverage will likely reimburse a portion of all related costs once you’ve met your deductible. This can be a lifesaver.

For example, cancer often requires expensive radiation or chemotherapy treatments, while feline leukemia virus (FeLV) does not yet have a definitive cure, so pets must make regular trips to the vet for therapies, exams, and observation. If your cat has chronic kidney disease, you may need to buy regular supplements or medications to treat your pet. Unfortunately, renal (kidney) failure is common in older cats, but pet insurance offers a financial safety net should your cat require emergency hospitalization.

NOTE: Many pet insurance plans cover congenital illnesses (present from birth), hereditary conditions, and breed-specific illnesses, as long as they are not pre-existing at the time of enrollment.

What’s Not Covered: Pre-Existing Conditions, Routine Care, and More

Cat insurance generally does not cover pre-existing conditions or preventive/routine care.

However, many insurers offer a wellness plan as an add-on feature to accident/illness insurance, which helps cover the cost of preventive care, such as annual exams and teeth cleanings.

Generally, cat insurance plans do not cover pre-existing conditions (but some plans do cover curable conditions after a certain waiting period with no recurring symptoms). If your cat comes down with an illness before your pet insurance kicks in, you’ll have to pay for the veterinary exam fees and treatment costs for that condition out of pocket.

Factors That Affect Cat Insurance Costs

The cost of cat insurance varies based on several factors. Here are the key elements that influence your premiums and coverage:

- Cat Breed and Health Risks Certain cat breeds are more prone to specific health issues, which can impact insurance costs. Breeds such as the Siamese, Persian, and Maine Coon are more likely to develop health conditions, which may result in higher insurance premiums due to the increased risk. Mixed-breed cats, such as Domestic Shorthairs or Domestic Longhairs, can also face health challenges, but the premiums may be lower compared to purebred breeds with known predispositions.

- Annual Deductible - The annual deductible is the amount you must pay before your cat insurance coverage takes effect. Paying a higher deductible usually means having a lower monthly premium.

- Reimbursement Rate - This is the percentage of covered veterinary costs that your policy provider will reimburse you after you meet your annual deductible. Having a high reimbursement rate means you’ll have more of your vet expenses back, but it might also come with higher premiums.

- Annual Limit - Insurance policies have an annual limit on the amount they will reimburse for covered medical expenses each year. The annual limit varies between plans, and policies with higher reimbursement limits usually cost more.

- Location and Veterinary Care Costs - Where you live can also influence your cat insurance premiums. Veterinary care costs vary widely between cities, states, and even zip codes. Areas with higher costs of living and more expensive veterinary services tend to have higher insurance rates. Conversely, in regions where vet care is more affordable, insurance premiums may be lower.

- Coverage Details - When focusing on coverage rather than just cost, it's important to check terms such as:

- Benefit Schedule: Many insurance companies provide fixed reimbursement amounts for various health issues, meaning you receive a set payment for particular treatments.

- Maximum Payout Per Incident: This is the maximum amount your provider will pay out for each separate claim. Keep in mind that higher payout limits usually mean higher premiums.

- Claim Expiration: To avoid missing out on reimbursements, be aware that policies have different time limits for submitting a claim after an event occurs.

- Waiting Period: Most policies include an initial waiting period before your coverage becomes active. This can range from just a few days to several weeks, depending on the provider and type of condition. Keep in mind that the exact effective date of your coverage is only determined after you’ve enrolled, so be sure to review your policy documents carefully to know when your benefits officially begin.

Having a clear understanding of these factors helps you make an informed decision in choosing which cat insurance plan best fits your pet’s needs and your budget.

Pro Tip: Refer to our guide on how pet insurance works to find the definitions of terms commonly used in policies.

Compare Top Pet Insurance Companies Side-by-Side

Use Pawlicy Advisor to get personalized quotes from leading brands and see how each plan stacks up — instantly.

100% free to use. No fees. No commitment.

Cat Insurance Costs: What to Expect in 2025

With rising veterinary costs, pet insurance is becoming a popular way for cat owners to handle unexpected expenses. In 2025, premiums will vary based on your cat’s age, breed, and coverage level. Here's what to expect.

Typical Monthly Premiums by Age and Breed

The average monthly cost of pet insurance for accidents and illnesses for cats is around $30. Although prices may vary based on your cat's age and breed. Younger cats usually cost less to insure.

- For younger cats (under 1 year old), plans can cost as low as $20 per month. These plans often offer basic coverage and are ideal for cats in their prime health.

- For older cats (5+ years), premiums tend to rise, and you can expect to pay closer to the $40-50 range. Older cats are more prone to developing health conditions, which increases insurance costs due to the higher risk.

- Breed-specific pricing: Certain breeds, particularly those with a history of health issues, may be subject to higher premiums. For example, breeds like Siamese, Persians, and Maine Coons may have higher insurance costs compared to mixed-breed or less health-prone cats.

When comparing pet insurance plans for your cat, remember that although lower premiums look appealing, it's crucial to check the coverage they provide to ensure your cat is protected when needed most.

Recommended Reading:

References

- Vetted Pet Care, "Why Is My Cat Lethargic?"

- Barry Vet Hospital, "How Often Do I Take My Kitten to Get a Veterinary Care Exam?"

- American Veterinary Medical Association (AVMA), "Caring for senior cats and dogs"

- American Society for the Prenvention of Cruelty to Animals (ASPCA), "Common Cat Diseases"

Do you want to find the best pet insurance?

Let's analyze your pet's breed, age, and location to find the right coverage and the best savings. Ready?

Analyze My PetAbout Pawlicy Advisor

The pet insurance marketplace endorsed by veterinarians, at Pawlicy Advisor we make buying the best pet insurance easier. By comparing personalized coverage and pricing differences we can save you a ton of money, up to 83% in some instances!

Instantly Compare Pet Insurance Plans

Guides

Determine If Pet Insurance Is Worth It

Comparison Charts

Find Your State

Dog Insurance

Director of Marketing & Foster/Rescue Parent - Pawlicy Advisor

Edwin Plotts rescues and rehomes cats in Savannah, GA - while leading Pawlicy Advisor's brand growth. He's a pet parent of two rescued sibling cats: Greyson and Babs. He's also an avid volunteer with Flatbush Cats and The Toby Project.