How Does Pet Insurance Work & What Is Covered?

Reviewed by Kari Steere, Licensed Insurance Producer

Updated: Jul 29, 2025

Pet insurance is a protective measure for unexpected veterinary costs for illness or injury in dogs and cats. Monthly or annual premiums protect you from these bills.

Accident-only plans cover emergencies like fractures or collisions. These core plans exclude preventive services and pre-existing issues. Accident-and-illness policies add coverage for cancer, diabetes, and genetic conditions, including needed treatments. Wellness riders cover routine care.

After any waiting period, you pay your vet directly, file a claim, and receive reimbursement within about a week. Pet insurance helps you choose care based on medical needs, not financial limits.

This guide will explain what the purpose of pet insurance is and what it covers. In addition, we will discuss the enrollment process, provide an explanation of how pet insurance works, and cover many other topics.

Compare Top Pet Insurance Companies Side-by-Side

Use Pawlicy Advisor to get personalized quotes from leading brands and see how each plan stacks up — instantly.

100% free to use. No fees. No commitment.

What Is Pet Insurance?

Pet insurance is a form of insurance that pays, partly or in total, for veterinary treatment of the insured person's ill or injured pet.

In other words, pet insurance is a health insurance policy that covers certain veterinary costs. It gives you peace of mind that, in the event that your dog or cat has an accident, illness, or emergency, it will receive the appropriate care without facing a significant financial burden.

How Does Pet Insurance Work?

Pet insurance is often a pay-and-claim arrangement. You first pick a policy and set its key levers: deductible, reimbursement percentage, and annual or per-incident limit, and then maintain the coverage with a monthly or annual premium.1

Once waiting periods end, you can visit any licensed vet, pay the full invoice at checkout, and file a claim (usually within 60-270 days, varies by provider) by uploading the itemized bill and any requested records.

After your deductible is satisfied, the company reimburses its chosen share of covered costs, which is often 80-100% up to your limit. The money is typically sent by direct deposit or check within about a week, with “vet-direct pay” offered by a few providers.

What's the Purpose of Pet Insurance?

The purpose of pet insurance is to provide a financial safety net by shifting the burden of unexpected vet bills to an insurer. One in three pets needs emergency care each year, yet most owners would stop treatment if the bill reached $1,500, according to a veterinary survey.2

A good policy reimburses the majority of expenses for accidents and illnesses, including surgeries, medications, and diagnostics. This allows timely care without relying on credit or facing euthanasia. Pet insurance offers both protection from large bills and peace of mind, often outperforming personal savings in urgent situations.

Why Get Pet Insurance?

Here are the main reasons why people get pet insurance:

Pets have accidents

Accidents like broken bones, torn nails, lacerations, and getting hit by a car can occur at any time. In fact, four out of five pets will experience at least one medical emergency throughout their lifetime.

Pets get sick

Vomiting and diarrhea are common symptoms that might occur frequently for small reasons or be warning indications of a more serious condition. The cost of treating chronic illnesses in dogs and cats, such as allergies, diabetes, and cancer, can be especially high due to the frequent trips to the vet, diagnostic tests, surgeries, and medications.

Veterinary bills can be hefty

Americans spent an estimated $32.3 billion on veterinary care and products in 2021, representing a nearly $1 billion increase from 2020.3 With pet health insurance, when an unexpected vet visit occurs, you may easily pay with your credit card, submit a claim, and if it is accepted, you will be reimbursed by the end of the week.

Savings accounts can be unreliable

Instead of relying on a savings account, which can take years to accumulate enough money to cover even one major vet bill. Purchasing an insurance policy is a great way to make sure you can afford the best veterinary care as soon as your pet needs it.

What Pet Insurance Covers

Pet insurance covers veterinary costs across three main coverage levels. Accident-only policies cover emergencies like broken bones or burns, but exclude illnesses and breed-specific issues.

Accident-and-illness plans, the industry standard, cover injuries and diseases such as infections, parasites, and chronic conditions, though they exclude preventive care and pre-existing problems.

Wellness add-ons handle routine check-ups, vaccines, and similar services, but not emergencies or illnesses.

Since coverage limits and exclusions vary, it’s essential to choose a plan that matches your pet’s breed-specific health risks.

What pet insurance covers depends on the type of plan you decide to enroll in.

Accident-only plans will only provide reimbursement for emergency care related to accidents, like if your pet is hurt by a car or injures themselves by falling down the stairs. This type of coverage does not cover illnesses or breed-specific issues, but only physical injuries such as fractures (broken bones), burns, cuts, etc.

Accident-illness plans provide coverage for both accidents and unexpected illnesses. It is the most common choice, as it represents about 98% of plans issued² by the pet insurance industry. This type of plan won't cover preventive care or pre-existing conditions, but you can expect reimbursement for almost everything else, including treatments for viral infections, parasites, hip dysplasia, and even tooth extraction in the event of dental diseases, in some cases.

NOTE: Many pet insurance companies sell supplemental pet wellness plans, known as policy riders, that cover routine care, preventative care, checkups, and yearly vaccines, but not much else. These are usually sold as add-on features to other health insurance plans. This type of plan does not cover accidents, common injuries, or emergency treatments for illnesses.

The best pet insurance plans can provide substantial coverage for the most expensive health treatments and diagnostics.

However, depending on your insurance plan, your policy may not cover every condition/expense your pet has. This is why it's so important to find a plan that covers your pet's breed-specific health risks.

So, to sum up, pet insurance can cover:

- Unexpected injuries/accidents (like foreign object ingestion, broken bones, and more)

- Unexpected illnesses (like cancer , glaucoma, hip dysplasia , parvovirus, and more)

- Surgery (like cruciate ligament tears , cataracts, and more)

- Medication

- Tests/diagnostics (like X-rays, blood tests, MRIs, and more)

- Emergency exam fees

In general, most pet insurance plans will cover medical expenses in the above categories as long as the surgery or care needed is not related to a pre-existing condition. The details will depend on the type of coverage (see the chart below) and the provider you choose

Some pet health insurance plans also cover:

Types of Pet Insurance Coverage

Coverage | Accident-Only | Accident-Illness | Accident-Illness + Wellness Add-on |

|---|---|---|---|

Emergency care for accidents | Yes | Yes | Yes |

Treatment & tests for injuries | Yes | Yes | Yes |

Emergency care for illnesses | No | Yes | Yes |

Treatment & tests for illnesses | No | Yes | Yes |

Breed-specific conditions | No | Yes | Yes |

Routine care | No | No | Yes |

Wellness exams | No | No | Yes |

Vaccines | No | No | Yes |

Pre-existing conditions | No | No | No |

🧡 RESOURCES:

What Does Pet Insurance Not Cover?

Most pet insurance plans exclude pre-existing conditions, which are any illnesses or injuries that occurred before coverage began. This rule still applies if you cancel one policy and start another. However, some providers cover curable conditions after a waiting period, provided there are no recurring symptoms.

Other Common Pet Insurance Exclusions:

- Pre-existing conditions

- Routine care/Wellness exams

- Preventative care

- Spay/Neuter

- Vaccination

- Pregnancy and/or birth

- Cosmetic and elective procedures

- Preventable diseases

- Bilateral conditions

- Exclusions

💡 NOTE: Although no pet health insurance providers cover pre-existing conditions, some providers will cover curable health conditions after a certain waiting period with no recurring symptoms. Also, pets with a pre-existing condition are still eligible for insurance, their coverage would only exclude the specific condition that already exists.

Learn More: Why pet insurance is worth it?

Other Types of Insurance Coverage For Pets

There are other types of insurance products that cover other types of pet expenses, such as pet liability and pet life insurance. Here are a few to keep in mind:

- Pet Health Insurance - covers the cost to treat your pet's illnesses and/or injuries.

- Renter's Insurance For Pets - covers any personal injury or damage your pet might cause to a visitor or guest at your rental property.

- Third-Party Liability Insurance - provides liability coverage for dog owners who neither own a home nor rent, and therefore have no financial protection in the event of a lawsuit.

- Pet Life Insurance - provides reimbursement for the pet’s value in the event it gets stolen or disappears, as well as replacement of future income in the case of show dogs. Insuring your canine’s life will also cover for funeral expenses.

Learn More: What Types of Pet Insurance Do I Need?

How Pet Insurance Works

Pet insurance works like property insurance, with your pet’s health as the asset. You choose a policy, set a deductible, reimbursement rate, and payout limits, then pay monthly or annual premiums. After waiting periods pass, typically two days for accidents and two weeks for illnesses, you can visit any licensed vet.

You pay the bill upfront, submit a claim, and get reimbursed within about a week, up to your policy’s cap. Plans are fee-for-service, not network-based, so they work at any clinic in the US. Pet insurance helps you manage costs by turning unpredictable vet bills into planned expenses.

We'll break down the general overview of how pet health insurance works in 5 steps:

Step 1: Choose a Plan & Customize Policy

Not all providers are the same. The majority of pet insurance policies typically pay for unexpected illnesses, accidents, surgeries, medications, tests, and diagnostics, as well as the costs of emergency care and exams. However, not all costs in those categories often qualify for reimbursement. The type of pet insurance coverage and the company you select will determine the specifics of your pet insurance policy.

The first thing you need to do is select your type of coverage, then customize plan by choosing from the different deductibles, reimbursement limits, and payout limits.

The deductible is the portion of the veterinary bill you're responsible for before your plan's reimbursement kicks in. Most pet insurance companies use an annual deductible. Some insurance companies offer a per-incident deductible, meaning if the same injury occurs more than once in future years, the deductible will no longer apply.

Reimbursement rate is the amount a pet insurance company pays you back for the cost of care. The most comprehensive pet health coverage will reimburse 80% to 100% of your total vet bill (after your deductible is met).

Limits are something you should consider when choosing a plan, especially as you anticipate how much and what type of care your pets might need for their ages and conditions:

- Per-incident limits cap how much you can be reimbursed for a single illness or accident. If exam fees, surgery, lab tests, medications, and follow-up care total $5,000 and your limit is $2,000, you are responsible for over half of the bill.

- Annual limits cap how much you can reimbursed within a 12-month period. Once you hit your plan's annual reimbursement limit, you are responsible for paying until your coverage resets for the year.

Pro tip: Researching breed requirements before choosing a pet insurance can be helpful. Consider the conditions your pet is most likely to experience over the course of their lifetime, and then check to see if they are covered. Keep in mind that each animal is unique, and their age, breed, and lifestyle will influence the health issues they are most prone to.

Step 2: Satisfy Enrollment Requirements

Some pet insurance providers require exams or medical records prior to enrolling your pet in a pet insurance policy.

Depending on the policy, some insurance companies may not cover older animals, while the majority do not cover animals that are younger than eight weeks old.

Finally, since some providers only offer coverage in certain states, your eligibility to enroll may be based on where you live.

Be sure to compare these requirements before choosing a plan.

Learn More: How to Compare Pet Insurance Plans

Step 3: Pay Insurance Premium

On a month-to-month basis, pet insurance works most like renters' insurance. You pay a monthly premium to your insurer for coverage.

Your premium is the fee you must pay each month (or year) to keep your insurance policy active. A higher monthly premium typically means you're paying for more coverage, so you shouldn't always go for the plan that has the lowest premium. Still, a plan with a low premium might be your best option if you're on a tight budget.

Some pet insurance providers also have a one-time enrollment fee and/or monthly transaction fees, which can be waived if you decide to pay annually.

💡 PRO TIP: If you need to save on monthly costs (your premium), you can customize your plan and lower the reimbursement rate, lower the limit, or raise the deductible. Some insurers will increase your premium as your pet ages or after you have filed a claim. Pawlicy Advisor provides a Lifetime Pricing Score to help predict such costs.

Step 4: Visit the Vet

Most insurers impose waiting periods for each type of claim that the policy covers. Illnesses typically have a longer waiting period (usually two weeks) than accidents (usually several days). The longest waiting periods are usually reserved for specific conditions like orthopedic problems and cruciate ligament issues, requiring six months or more before coverage begins.

Once the mandatory waiting period has passed, you can visit the vet as you normally would. You can benefit from your coverage at any licensed vet clinic or animal hospital in the U.S, and some providers will even cover your pet when traveling outside the country.

You will need to pay for the visit upfront at the time of service (this counts toward your deductible) and get reimbursed later after you submit a claim.

Step 5: File a Claim & Get Reimbursed

If your pet requires treatment for a covered illness, accident, or procedure, you will pay the veterinarian directly and file a claim with your pet insurance provider. Be sure to file your claim within the designated window (usually 60 to 270 days after the treatment).

Pet insurance companies offer different options/methods to file claims, including email, mail, fax, online portals, mobile apps.

Insurance companies may need paperwork or a medical history review from your veterinarian to process your claim, so be sure to save all receipts and documentation you receive from your vet appointment.

Policyholders are usually reimbursed via check or direct bank deposit, but some providers will offer to pay the veterinarian directly.

If your claim is approved, you will get reimbursed at the rate set in policy (up until to the annual/lifetime limit) after deductible is met. On average, policyholders get reimbursed within 5 to 9 days after submitting a claim.

Pet insurance payout offsets the cost of vet bills and can be used in conjunction with veterinary financing options.

Do You Have to Pay Upfront If You Have Pet Insurance?

In most cases, yes, you will need to pay your vet upfront for the treatment, unless your provider offers vet direct pay. This counts toward your deductible but once the deductible is met, you are still responsible for the insurance copayment (typically 10-30% of total vet bill, depending on your chosen reimbursement rate).

Pet insurance vs human health insurance

The main difference between pet insurance and human health insurance is that pet insurance resembles property insurance more than human health insurance because pets are legally considered property.

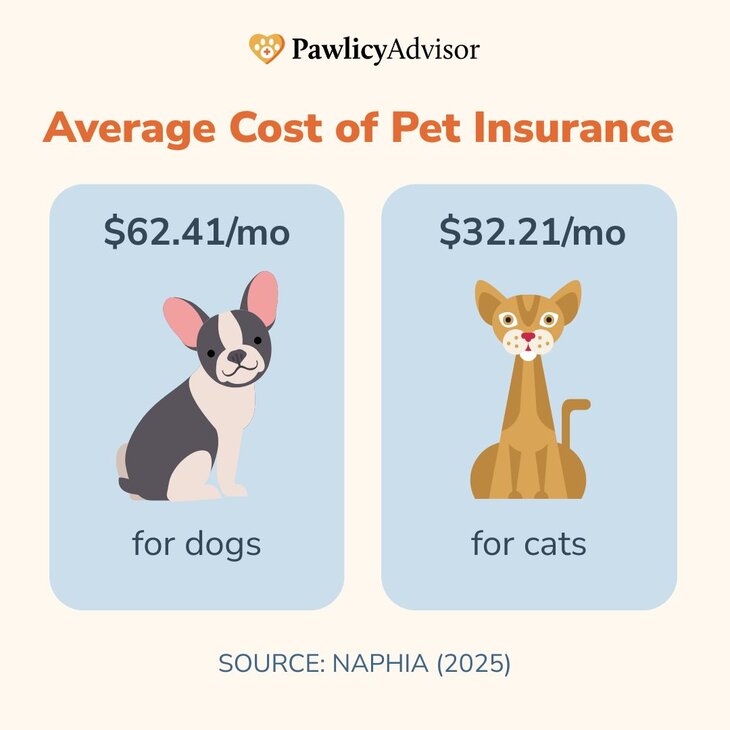

Unlike human health insurance, which relies on PPO or HMO networks and costs over $300 per month, pet insurance (accident and illness coverage) averages $32.21 per month for cats and $62.44 for dogs as of 2025.4

Pet insurance follows a fee-for-service model: you pay the vet bill upfront, then file a claim for reimbursement after meeting your deductible.

In contrast, human plans pay providers directly. Pet insurers can also deny coverage for pre-existing conditions, which human insurers are prohibited from doing under current U.S. law.

An insurance provider for pets can refuse to cover a pet's pre-existing condition. As of 2014, due to changes in healthcare law, human health insurance providers in the US are no longer able to refuse coverage of pre-existing diseases.

Learn More: What's The Difference Between Pet Insurance & Health Insurance?

See if pet insurance is right for you.

Instant results. No spam. 1M+ pet parents served.

How Much Does Pet Insurance Cost?

- Average Cost: $62.44/mo ($749.29/year) for dogs and $32.21/mo ($386.47/year) for cats.4

- Expected Range: $37.18 - $72.99/month for dogs and $23.84 - $49.76/month for cats

- Price Factors: Breed, age, location, insurer/carrier, coverage terms

Factors That Increase the Cost of Pet Insurance

- Size (height, weight)

- Breed

- Age (compared to its typical life expectancy)

- Location

- Common indoor and outdoor risks in area

- Term and length of insurance policy

- Reimbursement Rate

- Deductible

- Payout Limit

- Plan type

- Policy provider

You can save on pet insurance by enrolling when your pets are still young, as your monthly premiums are guaranteed to be lower. Some pet insurance providers will also give you a discount on your bill if you agree to make annual payments instead of monthly payments. Others offer discounts if you insure multiple pets under the same provider.

Another way to keep your premiums low is to select a higher deductible, but keep in mind that you’ll have to reach that deductible by paying out-of-pocket before your insurance plan begins to reimburse your veterinary costs.

Similarly, you can keep costs down if select a lower reimbursement rate or a lower coverage limit, but this will limit the amount you receive from your insurer if your pet gets seriously ill or injured.

Recommended Reading: How Much Pet Insurance Costs

Where to Buy Pet Insurance

There are three ways to enroll in pet insurance:

- Through insurers directly.

- Through employer benefits.

- Through the #1 pet insurance marketplace (recommended by veterinarians).

💡 NOTE: Wellness plans can be acquired as add-ons should you purchase accident-illness coverage through a top provider on Pawlicy Advisor's marketplace. You can also get a Wellness Plan as a separate enrollment through a dedicated wellness provider or your local veterinary clinic.

Detailed Insurance Provider Reviews

The #1 Pet Insurance Marketplace, Recommended by Veterinarians

As pet parents, we know searching for pet insurance is complicated. We know that review sites don't provide enough information. We also know that having to submit a quote form with "every" "single" "provider" is a horrible user experience.

Instead, pet parents can use Pawlicy Advisor to see pet insurance quotes from top providers, custom comparison charts, and ranked based on breed-specific health risks and lifetime pricing - all in one place.

Compare Top Pet Insurance Companies Side-by-Side

Use Pawlicy Advisor to get personalized quotes from leading brands and see how each plan stacks up — instantly.

100% free to use. No fees. No commitment.

The Problem With Simple Review Aggregators

Review aggregators can be a great tool for understanding context on customer service experiences - however, they should not be the deciding factor in your evaluation.

Simple review sites don't provide pet parents with transparency on policy details, breed exclusions, and lifetime costs. Negative reviews don't necessarily mean that the provider or the plan is a poor choice, rather, it's quite possible that the plan was a bad fit for the individual reviewer.

Similarly, good reviews don't offer much information. Every provider has good reviews. The number of reviews is more correlated review collection efforts or brand awareness, rather than how “good” an insurance option is.

The Magic Behind Pawlicy Advisor

Pawlicy Advisor analyzes your pet's health risks, coverage options on the market, and price differences to recommend a policy that will save you substantial money and frustration over your pet's lifetime.

See more 5-star reviews on Facebook and Google.

Fill out one form to run an analysis across hundreds of policy variations from top providers and compare plans in custom comparison charts.

Our goal is to transform the pet insurance industry and enable more people to get their pets the affordable care they need.

Learn More About Pawlicy:

Frequently Asked Questions

What is pet insurance and how does pet insurance work?

Pet insurance is health insurance for your pet. It covers (reimburses) the costs of treating unexpected injuries and illnesses, so you don't have to worry as much about expensive vet bills. Unlike human health insurance, you can use your benefits at any vet or animal hospital.

Is it worth it to have pet insurance?

One out of three pets will need emergency treatment, and most Americans can't afford unexpected veterinary bills. Pet insurance is worth it because it helps you afford these costs, so your pet always gets the care they need.

How do you use pet insurance?

After paying a vet bill, you can submit a claim for reimbursement to your insurance provider. Most pet insurance companies let you submit claims online, by phone, or by mail.

How does a pet insurance deductible work?

The deductible is the portion of the bill you're responsible for before you can start being reimbursed for veterinary costs. Most plans come with an annual deductible. For example, if your annual deductible is $1,000, you'll need to pay for $1,000 in veterinary costs each year before you can start getting reimbursed for veterinary costs.

What is the best pet insurance?

Every pet and pet parent has unique needs, but the most popular type of pet insurance is called an accident-illness plan. This type of plan covers the most expensive injuries and illnesses, and it's generally affordable for most pet parents.

When shopping on Pawlicy Advisor, rest assured we only work with the best providers in the industry - and our algorithm will analyze hundreds of options to help you compare the best dog & cat insurance plans based on breed, location, age, lifetime savings, and more.

How much is pet insurance and what does it cover?

The average cost for the most common pet insurance plans (accident-illness plans) is $28.57 for cats and $48.66 for dogs. This coverage reimburses emergency care as well as treatments and tests for unexpected accidents and illnesses like cancer, poisoning, foriegn ojbect injestion, surgery, X-rays, glaucoma, and more.

What factors determine the cost of pet insurance?

The size, breed, age, and geographic location of your pet all influence the cost of your insurance policy. The length of your policy and the company offering your plan also play a role. Finally, you get to determine what type of policy works best for you by selecting a quote that makes sense for your budget.

Can you customize your pet insurance plan after purchasing?

There's no "one-size-fits-all" solution for pet insurance, and many providers allow you to customize your plan to accommodate your personal needs and preferences. While sites like Pawlicy Advisor can help you pick a great pet insurance plan from the start, life happens and things can change, so you might want to change your plan after purchasing. Depending on your provider, this may be possible; however, you may be required to wait until your policy renewal to add or drop coverage to your plan for the following period.

How long does pet insurance take to kick in?

After you purchase insurance, there will be a waiting period in which some coverage is restricted. Waiting periods are determined by the pet insurance company, so it's important to check before you sign up. Most waiting periods last only 14 days.

How do you know which vets accept pet insurance?

Pet insurance doesn't pay your veterinarian directly. Instead, your provider will reimburse YOU for your veterinary costs after you pay your vet and submit a claim to the insurance company. This way, you don't have to worry about whether your vet takes a certain policy or not — you can use any veterinarian you like!

Can pet insurance cover neutering?

Most pet health insurance policies don't cover neutering, but some pet wellness plans will cover it.

Can pet insurance be transferred to a new owner?

Some pet insurance plans are transferable to a new owner. Contact your pet insurance provider to learn more about their transfer policies.

Can pet insurance drop you?

Yes. A pet insurance company might cancel your policy if you don't pay your monthly premiums. In addition, some pet insurance policies may drop levels of coverage after your pet reaches a certain age.

Can pet insurance be canceled?

Yes. Most providers allow you to cancel your pet insurance policy at any time

Can pet insurance cover antibiotics?

If your pet insurance plan covers prescription medications, then it should cover antibiotics, unless they are prescribed to treat a pre-existing condition.

How does pet insurance work nationwide?

You can use most pet insurance plans at any veterinarian you choose. However, if you decide to move to a new state, your policy may change based on state laws and other factors.

Where can you get pet insurance?

You can get pet insurance by contacting any pet insurance company directly. The easiest way to get it is to search for a plan on Pawlicy Advisor and sign up online.

Why is pet insurance important?

Many pet parents must make decisions about their pet's care based on cost. However, pet insurance helps by reducing financial risk and ensures your pet can always have access to quality care at an affordable rate.

Why get pet insurance?

Most pet owners get pet insurance for peace of mind. It protects them against the financial risk of expensive veterinary service often required for sick or injured pets.

Will pet insurance cover spaying?

Most pet insurance plans won't cover the cost of spaying, but a pet wellness plan can cover the procedure.

Will pet insurance cover surgery?

Yes. A comprehensive accident-and-illness pet insurance plan should cover most surgeries. However, it will not cover elective surgeries or surgeries to treat a pet's pre-existing conditions.

Will pet insurance cover vaccinations?

Neither accident-and-illness plans nor accident-only plans cover vaccinations, but you can get them covered under a pet wellness plan as an add-on feature.

Will pet insurance cover hip dysplasia?

Many pet insurance plans cover the cost of hip dysplasia, but you may be subject to a waiting period post-enrollment for coverage to begin.

Will pet insurance cover medication?

Yes. Many pet insurance plans cover prescription medications.

Will pet insurance cover hernia surgery?

Yes. Many pet insurance plans cover hernia surgeries, but they won't cover hernia surgery if the hernia is a pre-existing condition.

When can you claim a vet bill?

You can submit a claim for reimbursement after paying your veterinarian for their services. However, some policies may require you to wait a certain number of days after your policy activates before you can submit a claim.

Can pet insurance be backdated?

If your pet passes away, many pet insurance companies will backdate your premiums and refund you. However, no pet insurance plan will cover treatment provided before your policy enrollment date.

What is pet insurance like?

Pet insurance works a lot like car insurance. It's designed to protect you from financial risk by reimbursing you for planned and unplanned vet costs.

Does pet insurance cover heart murmurs?

Pet insurance can cover a heart murmur, but not if it's a pre-existing condition. If your pet develops a heart murmur after your effective policy date, then your insurance should cover it.

Do you want to find the best pet insurance?

Let's analyze your pet's breed, age, and location to find the right coverage and the best savings. Ready?

Analyze My PetAbout Pawlicy Advisor

The pet insurance marketplace endorsed by veterinarians, at Pawlicy Advisor we make buying the best pet insurance easier. By comparing personalized coverage and pricing differences we can save you a ton of money, up to 83% in some instances!

Instantly Compare Pet Insurance Plans

Guides

Determine If Pet Insurance Is Worth It

Comparison Charts

Find Your State

Dog Insurance

Pawlicy Advisor is the #1 pet insurance marketplace in the U.S. Recommended by veterinarians. Trusted by 1M+ Americans. Our team of veterinary advisors and licensed insurance experts are dedicated to helping pet parents give their dogs and cats the best possible care.